In the fast-paced world of finance, accountants need reliable tools. Accounting software makes their tasks easier and more efficient.

Finding the right accounting software can be a game-changer. With so many options available, it can be tough to choose the best one. Accountants need software that is user-friendly, accurate, and cost-effective. Whether you are managing small business finances or handling complex accounts, the right software can streamline your work.

In this blog post, we will explore the 10 best accounting software for accountants. We will look at features, benefits, and what makes each one stand out. This guide will help you find the perfect tool to boost productivity and accuracy in your accounting tasks.

Quickbooks Online

QuickBooks Online is a popular choice for accountants. It offers a range of features designed to simplify accounting tasks. This cloud-based software helps manage finances efficiently. Let’s explore its key features and the pros and cons.

Key Features

- Cloud-Based: Access your data from anywhere, anytime.

- Invoicing: Create and send invoices quickly.

- Expense Tracking: Track and categorize expenses easily.

- Bank Reconciliation: Sync your bank accounts seamlessly.

- Reporting: Generate detailed financial reports.

- Payroll Integration: Manage payroll within the platform.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use interface | Monthly subscription fee |

| Wide range of features | Learning curve for advanced features |

| Cloud access | Occasional sync issues |

| Strong customer support | Limited offline access |

Credit: trueproassociates.com

Xero

Xero is a popular accounting software used by many accountants. It offers a range of features that help streamline financial management. With its user-friendly interface, Xero is a great choice for both small and large businesses.

Key Features

- Cloud-based platform: Access your data anytime, anywhere.

- Automatic bank feeds: Sync transactions from your bank.

- Invoicing: Create and send invoices quickly.

- Expense tracking: Keep track of your expenses easily.

- Payroll management: Manage employee pay and benefits.

- Multi-currency support: Handle transactions in multiple currencies.

- Inventory management: Monitor stock levels and sales.

- Financial reporting: Generate detailed financial reports.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Xero’s powerful features make it a top choice for accountants. Its ease of use and robust security ensure your data is always safe and accessible.

Freshbooks

FreshBooks is a popular accounting software designed for small businesses and freelancers. It offers an intuitive interface and robust features that simplify accounting tasks. Whether you need to manage invoices, track expenses, or generate financial reports, FreshBooks has got you covered.

Key Features

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Easily track and categorize expenses.

- Time Tracking: Log hours and bill clients accurately.

- Reports: Generate detailed financial reports.

- Multi-Currency Support: Handle transactions in various currencies.

- Project Management: Collaborate on projects and assign tasks.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Credit: linkmybooks.com

Zoho Books

Zoho Books is a versatile accounting software designed for small businesses and accountants. It offers a suite of features that streamline financial management and simplify accounting tasks. With its user-friendly interface and comprehensive functionality, Zoho Books stands out as a robust tool for financial management.

Key Features

Zoho Books offers a range of features that cater to various accounting needs:

- Invoicing: Create and send professional invoices with ease.

- Expense Tracking: Track and categorize expenses for better management.

- Bank Reconciliation: Automate bank transactions and reconciliation processes.

- Project Management: Manage projects and track time spent on tasks.

- Inventory Management: Keep track of stock levels and manage orders.

- Financial Reporting: Generate detailed financial reports for insights.

Pros And Cons

| Pros | Cons |

|---|---|

| User-friendly interface | Limited integrations compared to competitors |

| Comprehensive feature set | Advanced features require higher pricing tiers |

| Strong customer support | Customization options are limited |

| Affordable pricing | Initial setup can be time-consuming |

| Multi-currency support | Learning curve for new users |

Wave

Wave is a popular and user-friendly accounting software designed for small businesses and freelancers. It offers a range of features that make managing finances easier and more efficient. With Wave, you can create and send invoices, track expenses, and generate reports, all for free.

Key Features

- Invoicing: Create and send professional invoices in minutes.

- Expense Tracking: Easily track and categorize expenses.

- Bank Reconciliation: Connect your bank accounts for seamless reconciliation.

- Reporting: Generate detailed financial reports.

- Payroll: Manage payroll for your business (paid feature).

- Receipts: Scan and store receipts digitally.

Pros And Cons

| Pros | Cons |

|---|---|

| Free to use | Limited customer support |

| User-friendly interface | Ads in the free version |

| Good for small businesses | Advanced features require payment |

| Includes invoicing and receipt scanning | Does not support multi-currency |

Wave offers a comprehensive solution for small business accounting. Its user-friendly interface and essential features make it a go-to option for many. While it has some limitations, the pros outweigh the cons for many users.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a popular choice among accountants. It offers comprehensive features for small and medium-sized businesses. Its user-friendly interface and advanced tools make it ideal for accountants who seek efficiency and reliability.

Key Features

- Real-time reporting: Track your financial data in real-time.

- Invoicing: Create, send, and track professional invoices.

- Bank reconciliation: Match transactions to your bank statements.

- Multi-currency support: Handle transactions in different currencies.

- Mobile app: Access your accounts on the go.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use interface | Limited customization options |

| Strong customer support | Higher cost for advanced features |

| Comprehensive reporting tools | Some users find it complex initially |

| Cloud-based access | Occasional sync issues |

Netsuite Erp

NetSuite ERP is a popular choice among accountants. It offers a comprehensive suite of tools designed to streamline financial processes. This software helps manage core business functions such as finance, inventory, and eCommerce. NetSuite ERP stands out for its cloud-based system. This feature ensures data is accessible from anywhere, anytime.

Key Features

NetSuite ERP comes packed with features. It includes a robust financial management module. This module handles everything from general ledger to accounts receivable. Another key feature is the inventory management system. This system helps keep track of stock levels in real-time. The software also offers order management. This feature ensures smooth order fulfillment. Additionally, the eCommerce integration allows businesses to manage online sales. All these features work together to provide a seamless experience.

Pros And Cons

NetSuite ERP has many pros. One major advantage is its cloud-based system. This ensures data is always accessible. Another pro is the comprehensive feature set. It covers various business needs. The software is also highly customizable. This allows businesses to tailor it to their needs.

Despite its many pros, there are some cons. One downside is the cost. NetSuite ERP can be expensive. Another con is the learning curve. It may take some time to get used to the system. Additionally, some users find the interface complex. Overall, while there are a few drawbacks, the benefits often outweigh them.

Kashoo

Kashoo is an easy-to-use accounting software designed for small businesses and freelancers. It offers a simple interface with powerful features that make accounting tasks a breeze. Kashoo helps you manage your finances efficiently and stay on top of your business operations.

Key Features

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Easily track all your business expenses.

- Bank Reconciliation: Connect your bank accounts for seamless reconciliation.

- Multi-Currency Support: Handle transactions in various currencies.

- Real-Time Reporting: Get instant insights into your financial health.

- Mobile App: Manage your finances on the go with the Kashoo mobile app.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use for non-accountants | Limited integrations with third-party apps |

| Affordable pricing plans | Basic inventory management features |

| Excellent customer support | Advanced features may require a learning curve |

Freeagent

FreeAgent is a popular accounting software tailored for small businesses and freelancers. Its user-friendly interface and comprehensive features make managing finances simple. FreeAgent allows users to handle invoicing, expenses, and project management efficiently.

Key Features

FreeAgent offers multiple features that simplify accounting tasks. Users can track income and expenses, create and send invoices, and manage projects. The software also supports bank integrations, making it easy to import transactions.

Another key feature is the ability to generate financial reports. These reports provide insights into business performance. FreeAgent also includes time tracking, which is useful for service-based businesses.

Tax management is another strong point. FreeAgent helps with VAT returns and Self Assessment filing. This ensures compliance with tax regulations. The software is cloud-based, so you can access your data anytime, anywhere.

Pros And Cons

Pros:

- Easy to use interface

- Comprehensive invoicing tools

- Supports multiple currencies

- Excellent customer support

- Mobile app available

Cons:

- Limited customization options

- Higher price for premium features

- Can be overwhelming for very small businesses

Credit: toaglobal.com

Accountedge Pro

AccountEdge Pro is a robust accounting software designed for small to medium-sized businesses. It offers comprehensive tools to manage financials efficiently. With its user-friendly interface and powerful features, AccountEdge Pro is a favorite among many accountants.

Key Features

- Double-Entry Accounting: Ensures accurate financial records.

- Bank Reconciliation: Simplifies the process of matching transactions.

- Inventory Management: Tracks stock levels and manages inventory.

- Payroll Processing: Handles employee payments and tax calculations.

- Time Billing: Tracks billable hours efficiently.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Comparison And Conclusion

Choosing the right accounting software is crucial for your business. This section compares the best accounting software for small businesses and large enterprises. We’ll help you find the perfect fit for your needs.

Best For Small Businesses

Small businesses need software that is easy to use and affordable. Here are the top choices:

- QuickBooks Online: User-friendly, with strong invoicing features.

- FreshBooks: Excellent customer service and time tracking.

- Wave: Free software with essential features for small businesses.

These options provide essential accounting tools without breaking the bank.

Best For Large Enterprises

Large enterprises require robust software with advanced features. Here are the best options:

- NetSuite: Comprehensive ERP features and scalability.

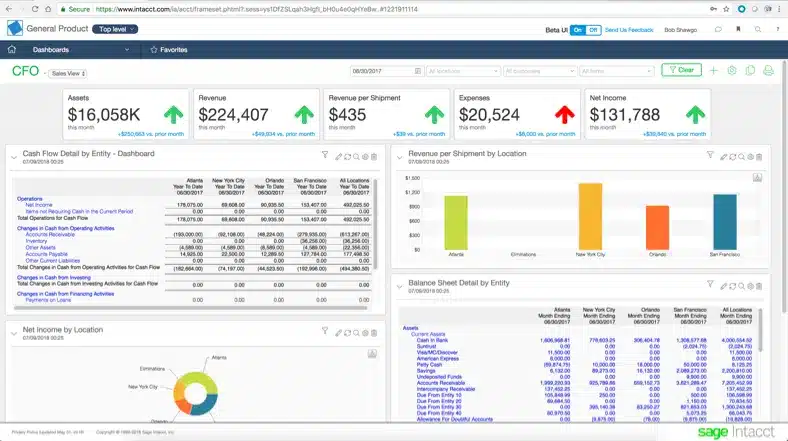

- Sage Intacct: Strong financial management and reporting tools.

- Microsoft Dynamics 365: Integrates well with other Microsoft products.

These software options offer advanced capabilities to handle complex accounting needs.

Final Thoughts

In summary, the best accounting software depends on your business size and needs. Small businesses benefit from simplicity and affordability. Large enterprises need advanced features and scalability.

Evaluate your requirements and choose the software that fits best. This ensures efficient and accurate financial management.

Frequently Asked Questions

What Is The Best Accounting Software For Accountants?

The best accounting software varies based on needs. QuickBooks, Xero, and FreshBooks are top choices for many accountants.

Can Accounting Software Help With Tax Preparation?

Yes, many accounting software programs offer features for tax preparation. They help streamline tax filing processes and ensure accuracy.

Is Accounting Software Secure?

Most accounting software provides strong security features. These include data encryption, secure access controls, and regular backups to protect financial information.

How Much Does Accounting Software Cost?

The cost varies. Some software offers free versions with limited features, while premium versions can range from $10 to $100 monthly.

Conclusion

Choosing the right accounting software can simplify your tasks. The options listed cater to various needs and budgets. Evaluate each one based on your requirements. Efficiency and ease of use should be your top priorities. Good software can save you time and reduce errors.

Invest wisely in the best tool for your practice. Happy accounting!