Boost efficiency with AI-powered 1099 software for accounting firms! Automate tax forms, ensure accuracy, and stay IRS-compliant—fast & effortless

Every accounting firm faces the daunting task of handling 1099 forms for clients. The process can be overwhelming without the right tools. This is where 1099 software comes in. It automates the filing, tracking, and reporting of 1099 forms. This saves time and reduces errors.

With so many options available, choosing the best software can be challenging. The right 1099 software can streamline workflows and ensure compliance. This introduction explores why 1099 software is essential for accounting firms and how it can make the tax season less stressful. Let’s delve into how these tools can transform your accounting practices.

Credit: www.tax1099.com

Introduction To 1099 Software

1099 Software simplifies tax reporting for accounting firms. It streamlines the process of managing and filing 1099 forms. This tool ensures accuracy and efficiency, saving valuable time for accountants.

What Is 1099 Software?

1099 software helps accounting firms manage tax forms. This software automates filling and filing of 1099 forms. It saves time and reduces errors. Easy-to-use interfaces guide users through the process. The software ensures compliance with IRS regulations. Accountants can quickly generate reports. It also stores data securely.

Importance For Accounting Firms

Using 1099 software is crucial for accounting firms. It simplifies the tax filing process. Firms can handle large volumes of data efficiently. This software reduces the risk of mistakes. It also saves time, allowing firms to focus on other tasks. Clients appreciate faster and accurate service. This software helps firms stay organized and compliant. It is an essential tool for modern accounting.

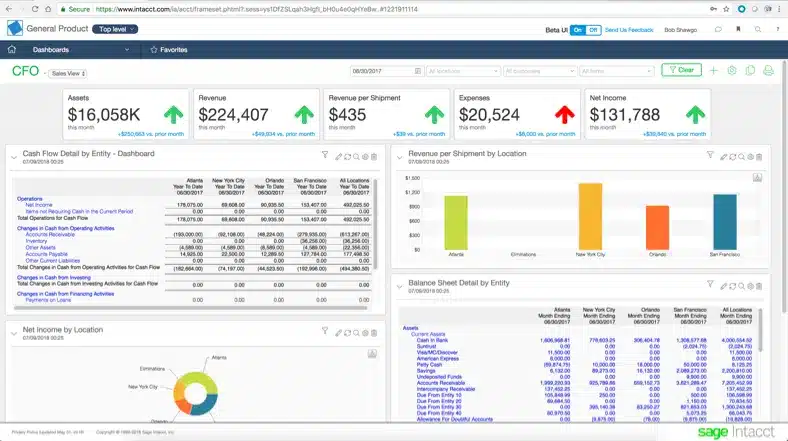

Credit: www.getcone.io

Key Features

Save time with automated data entry. The software pulls info from forms. This reduces manual work. Data accuracy improves. Errors are fewer. Processing is faster.

The software has error detection. It checks for mistakes in your data. Alerts you to fix them. Keeps your records clean. Helps avoid costly errors.

E-filing is easy. The software supports e-filing capabilities. Submit forms online. No need for paper. Faster processing. Get confirmation quickly.

Benefits For Accounting Firms

This software helps save time. Manual entries take hours. This tool does it faster. No more long nights at the office. Accountants can focus on other tasks. Time saved means more clients handled.

Errors in numbers can cause big problems. This software reduces mistakes. It checks and rechecks data. Accurate numbers build trust. Clients feel safe with your work.

Happy clients are key. They like fast and accurate service. This tool helps you deliver both. Clients get their reports on time. They trust your firm more. They stay with you longer.

Credit: www.accessnewswire.com

Choosing The Right 1099 Software

Selecting good 1099 software is crucial. Think about ease of use. The software should be simple. Your team should learn it fast. Integration with other tools is important. It saves time. Cost is another factor. Pick software that fits your budget. Support is key too. Good support helps when you have issues. Security is vital. Ensure the software keeps data safe.

There are many options available. TurboTax is popular. It is user-friendly and reliable. QuickBooks is another choice. It integrates well with other tools. TaxSlayer offers good support and is cost-effective. H&R Block is trusted and secure. Each option has its pros and cons. Choose based on your needs.

Implementation Process

Implementing 1099 software for accounting firms involves several steps. First, set up the software. Next, import client data and customize settings. Finally, train staff for smooth operation.

Initial Setup

Start by installing the 1099 software on your computers. Follow the provided guidelines for installation. Ensure all staff have access to the software. Check compatibility with your current system. Update your operating system if needed.

Training Staff

Begin by organizing a training session for your team. Use simple step-by-step guides to explain the software. Create a practice environment for hands-on learning. Encourage staff to ask questions. Provide access to tutorial videos and user manuals. Conduct follow-up sessions for additional support. Ensure everyone feels confident using the software.

Common Challenges

Data migration is a major challenge. Moving data to new software can cause errors. These errors can lead to incorrect reports. Some data might get lost during the move. This can affect business decisions.

Another problem is compatibility. Not all data formats are the same. This can make the process slow. It can also require extra work to fix issues. This takes up valuable time.

Clients might need to relearn the new system. This can be confusing. Training takes time and resources. It can also delay normal work.

Best Practices

Updating 1099 software regularly is crucial. It ensures compliance with the latest tax laws. New features often improve efficiency and user experience. Regular updates fix bugs and enhance security. Missing updates can lead to errors or data breaches. Schedule regular checks for software updates. This keeps your firm running smoothly.

Data security should be a top priority. Use strong passwords and change them regularly. Enable two-factor authentication for added protection. Encrypt all sensitive client data. Always back up important data in multiple locations. Limit access to confidential information. Only authorized personnel should have access. Regularly train staff on data security practices.

Future Trends In 1099 Software

AI helps to improve 1099 software. It reduces manual work. The software can identify errors quickly. This saves time and effort. Automation is another big trend. It simplifies tasks. This means fewer mistakes. AI and automation make processes faster. They also make them more accurate. Accounting firms benefit a lot. They can focus on more important tasks.

Cloud integration is growing fast. It allows access from anywhere. This is very helpful. Accountants can work remotely. They can share files easily. It also offers better security. Data is stored safely in the cloud. No need for physical storage. This reduces costs. It is also easy to update software. Updates happen automatically. This keeps the system current.

Frequently Asked Questions

What Is 1099 Software For Accounting Firms?

1099 software helps accounting firms manage and file 1099 forms. It simplifies the process by automating data entry, calculations, and submissions.

How Does 1099 Software Benefit Accounting Firms?

1099 software streamlines the 1099 filing process, saving time and reducing errors. It ensures compliance with IRS regulations.

Can 1099 Software Integrate With Other Accounting Tools?

Yes, most 1099 software integrates with popular accounting tools. This allows seamless data transfer and efficient workflow management.

Is 1099 Software Easy To Use For Accounting Firms?

Yes, 1099 software is user-friendly and designed for accounting professionals. It offers intuitive interfaces and step-by-step guidance.

Conclusion

Choosing the right 1099 software can simplify tasks for accounting firms. It saves time and reduces errors. Many options exist, so find one that fits your needs. Consider ease of use, cost, and support. A good choice will improve efficiency and client satisfaction.

Stay organized and compliant with the right software. Invest in a tool that helps your firm thrive.