Yes, you need accounting software. It’s crucial for modern businesses.

Managing finances can be overwhelming. Manual bookkeeping takes time and is prone to errors. Accounting software simplifies this process. It automates tasks and ensures accuracy. This saves time and reduces stress. From small businesses to large enterprises, everyone can benefit.

It helps with invoicing, tracking expenses, and generating reports. Plus, it offers real-time insights into financial health. This means better decision-making and growth opportunities. Still unsure? Let’s explore why accounting software is a smart choice for your business.

Benefits Of Accounting Software

Accounting software offers numerous benefits for businesses of all sizes. It helps streamline financial processes and ensures accuracy. Let’s explore the major advantages of using accounting software.

Efficiency And Accuracy

Manual bookkeeping can be time-consuming and error-prone. Accounting software automates tasks, saving time and reducing mistakes. With real-time data entry, you get accurate financial records. This ensures that your financial statements are always up-to-date.

Generating reports becomes quick and easy. You can track expenses, revenue, and profit with just a few clicks. The software also helps in managing invoices and payments efficiently.

Cost Savings

Hiring a full-time accountant can be expensive. Accounting software reduces the need for additional staff. This helps small businesses save money. The software also minimizes errors, which can be costly to fix.

Automated processes reduce the time spent on financial tasks. This allows you to focus on other important aspects of your business. Investing in accounting software proves cost-effective in the long run.

Key Features To Look For

Choosing the right accounting software is crucial for your business. Knowing the key features to look for can help you make an informed decision. These features ensure that the software meets your needs, saves time, and helps manage your finances efficiently.

Automation Capabilities

Automation capabilities are vital in accounting software. They reduce manual work and save time. Look for software that automates tasks like invoicing, expense tracking, and payroll.

Automation helps minimize errors. It ensures accuracy in financial records. Automated reminders for bill payments and follow-ups on overdue invoices are also beneficial.

Here are some common tasks that should be automated:

- Invoice generation and sending

- Expense tracking

- Payroll processing

- Bank reconciliation

- Tax calculations

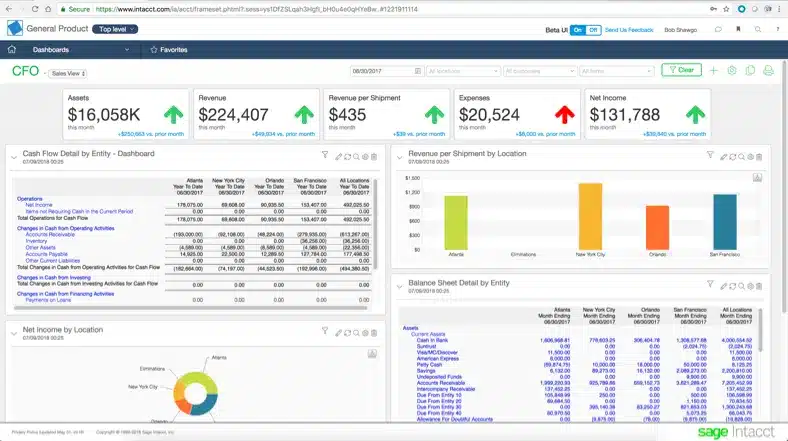

Real-time Reporting

Real-time reporting offers up-to-date financial information. It helps you make quick, informed decisions. With real-time data, you can see your cash flow, profits, and losses at any moment.

Look for software that provides customizable reports. This allows you to focus on the metrics that matter most to your business.

Real-time reporting features to consider:

- Cash flow statements

- Profit and loss reports

- Balance sheets

- Sales reports

- Expense reports

These reports should be easy to generate and understand. They help you keep track of your financial health.

Challenges And Considerations

When deciding to invest in accounting software, understanding the challenges and considerations is essential. This section covers the common hurdles faced by businesses, ensuring you make an informed decision.

Integration Issues

One of the major challenges is integration issues. Many businesses use multiple software systems. Ensuring your new accounting software works seamlessly with existing tools can be tough. Compatibility problems can lead to data discrepancies, which can be costly and time-consuming to fix.

Creating a smooth integration might require additional plugins or custom development. Both options can increase costs. It is crucial to check if the software supports the required integrations before making a purchase.

Learning Curve

Another key consideration is the learning curve. New software often requires training. Employees may need time to become proficient, impacting productivity. Some software options offer user-friendly interfaces, while others are more complex.

To ease the learning process, many vendors provide training materials, webinars, and customer support. Evaluate the availability and quality of these resources. Also, consider the technical aptitude of your team. Choosing software that matches their skills can reduce training time.

Here’s a quick look at what to consider:

- Ease of use

- Availability of training resources

- Compatibility with current systems

- Support from the vendor

By addressing these challenges, you can ensure a smoother transition to accounting software. This helps in maximizing the benefits while minimizing disruptions.

Cloud-based Vs. On-premise Solutions

Choosing the right accounting software can be difficult. There are two main options: cloud-based and on-premise solutions. Each has its own set of advantages and disadvantages. To help you decide, let’s look at the pros and cons of both options.

Pros And Cons Of Cloud-based

Cloud-based accounting software is accessible from anywhere with an internet connection. This makes it a popular choice for many businesses.

| Pros | Cons |

|---|---|

|

|

Pros And Cons Of On-premise

On-premise accounting software is installed locally on your company’s computers. This option offers more control over your data.

| Pros | Cons |

|---|---|

|

|

Security Concerns

Accounting software offers many benefits. Still, security concerns can make you hesitate. Your financial data is sensitive. You need to ensure its safety. Let’s explore how accounting software protects your data.

Data Protection Measures

Most accounting software uses encryption. This keeps your data safe from hackers. Encryption turns your data into unreadable code. Only you and authorized users can decode it. Regular backups are another protection measure. Your data is saved in multiple locations. If one backup fails, another can restore your data.

Compliance With Regulations

Accounting software follows strict regulations. These regulations ensure your data is handled correctly. Software companies update their systems to comply with new laws. This saves you from legal issues. It also ensures your data is secure. Proper compliance builds trust with your clients.

Credit: envoice.eu

Future Trends In Accounting Software

Accounting software is evolving quickly. The future trends in accounting software are exciting. These trends promise to simplify financial tasks and improve accuracy.

Ai And Machine Learning

AI and machine learning are transforming accounting. These technologies automate repetitive tasks. They reduce human errors. AI helps in predicting financial trends. This aids in better decision-making. Machine learning improves over time. It learns from past data. This makes accounting more efficient and reliable.

Blockchain Integration

Blockchain offers transparency and security. It records transactions in an immutable way. This makes fraud detection easier. Blockchain integration in accounting software ensures data integrity. It also simplifies audits. With blockchain, transactions are verified quickly. This saves time and reduces costs. It is a promising trend in accounting software.

Making The Decision

Deciding whether to invest in accounting software can be tough. Many business owners wonder if the benefits outweigh the costs. Understanding your specific needs and analyzing the potential benefits can help. Let’s break down the decision-making process.

Assessing Business Needs

First, consider the size of your business. A small shop with few transactions might not need complex software. Larger businesses with many transactions will find software helpful. Look at the volume and complexity of your financial tasks. Do you spend too much time on bookkeeping? Do you struggle with tracking expenses? Answering these questions can guide your decision.

Think about future growth. As your business grows, accounting tasks will increase. Software can simplify these tasks. It can also provide insights into your financial health. This can help you make informed decisions.

Cost-benefit Analysis

Next, consider the cost of the software. Prices vary widely. Some options are affordable, while others are more costly. Compare these prices with the time and effort saved. Manual bookkeeping can be time-consuming. Time is money. Software can automate tasks and reduce errors. This saves time and money in the long run.

Think about the value of accurate financial data. Errors in bookkeeping can lead to financial problems. Software reduces the risk of mistakes. It also provides real-time financial reports. These reports help you understand your financial position. This is valuable for making business decisions.

Consider the potential return on investment. Good software can pay for itself over time. Evaluate the benefits against the costs. This will help you make an informed decision.

Credit: www.freshbooks.com

Credit: envoice.eu

Frequently Asked Questions

What Is Accounting Software?

Accounting software is a tool that helps businesses manage financial transactions. It automates tasks like invoicing and tracking expenses. This software increases accuracy and efficiency in financial reporting.

Do Small Businesses Need Accounting Software?

Yes, small businesses benefit from accounting software. It simplifies bookkeeping and helps manage finances efficiently. It also provides insights into financial health, helping businesses grow.

Is Accounting Software Easy To Use?

Most accounting software is user-friendly and designed for non-accountants. It often includes tutorials and customer support. This makes it accessible for business owners.

Can Accounting Software Save Money?

Yes, accounting software can save money by reducing manual errors. It also streamlines financial tasks, saving time and increasing productivity. This efficiency can lead to cost savings.

Conclusion

Choosing the right accounting software can simplify your business operations. It saves time, reduces errors, and provides financial insights. Small or large businesses benefit from streamlined processes. Consider your needs and budget before deciding. The right tool can make managing finances easier.

Evaluate options carefully and invest wisely. Your business deserves efficient financial management.