Using ADP Payroll Software can streamline your payroll process. It simplifies tasks, saving time and reducing errors.

In this guide, you’ll learn how to use ADP Payroll Software effectively. ADP Payroll Software is a powerful tool for businesses. It helps manage employee payments, taxes, and other payroll needs. Many companies struggle with payroll management, leading to mistakes and wasted time.

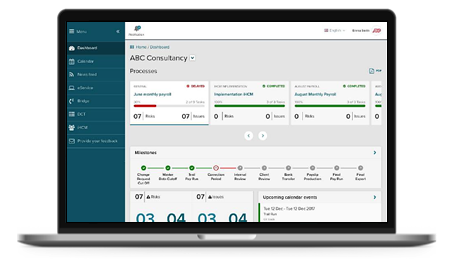

ADP aims to solve these problems with its user-friendly interface and robust features. Whether you are a small business or a large corporation, understanding how to use ADP Payroll Software can make a significant difference. In this blog post, we’ll walk you through the steps to get started, ensuring you maximize its potential and keep your payroll operations smooth and efficient.

Introduction To Adp Payroll Software

ADP is a tool for managing payroll. It helps businesses pay employees. It tracks hours worked and calculates pay. ADP also handles taxes. Many businesses use it. It’s known for being reliable and secure. The software simplifies complex tasks. It saves time. It reduces errors.

- Automated Payroll: Calculates pay and deductions.

- Tax Filing: Handles tax forms and payments.

- Employee Self-Service: Workers can view their info.

- Reports: Generate detailed payroll reports.

- Direct Deposit: Pays employees directly to their bank.

Credit: au.adp.com

Setting Up Your Adp Account

First, visit the ADP website and click on the “Sign Up” button. Fill in your personal details like name, email, and phone number. Choose a strong password to keep your account safe. Follow the steps to verify your email and complete the registration. Keep your login details in a safe place.

Log in to your account and go to the Settings page. Enter your company’s name and address. Add your tax information and choose the payroll schedule that fits your needs. Make sure all details are correct. This will ensure smooth processing of your payroll.

Employee Information Management

To add a new employee, log in to your ADP account. Select ‘Employee’ from the menu. Click ‘Add New Employee’. Enter the required details. These details include name, address, and job title. Save the changes. The new employee is now in the system. This process ensures accurate payroll management.

Go to the ‘Employee’ section. Find the employee you need to update. Click on their name. Edit the necessary details. You can update their address, phone number, or job title. Save the changes. Always keep employee records up to date. This practice helps avoid payroll errors.

Processing Payroll

ADP Payroll Software simplifies processing payroll. It streamlines employee payment management, ensuring accuracy and compliance. Easily track hours, calculate wages, and handle taxes.

Entering Payroll Data

First, log into the ADP system. Select the payroll tab. Enter each employee’s hours worked. Include any overtime. Input salary information for salaried workers. Verify the accuracy of the data. Double-check for any errors. Save your work regularly. This prevents data loss. Use the save button often.

Reviewing And Approving Payroll

Review the entered data. Look for mistakes. Ensure all hours are correct. Check overtime entries. Confirm salary amounts. Once verified, approve the payroll. Use the approve button. This will process the payments. Payments will be scheduled. Employees will receive their pay. Review your approval one last time. Make sure everything is correct.

Direct Deposits And Payments

ADP Payroll Software simplifies direct deposits and payments. Set up employee bank details and schedule payments effortlessly. Ensure timely and accurate payroll processing.

Setting Up Direct Deposit

Direct deposit is simple. First, gather your employees’ bank details. This includes bank name, account number, and routing number. Next, enter these details into the ADP system. Make sure the information is correct. Incorrect data can delay payments. Then, schedule the payment dates. Your employees will get paid on these dates. The money goes directly to their bank accounts. No need for paper checks. It saves time and reduces errors.

Issuing Paper Checks

Sometimes, paper checks are needed. For this, go to the payment section in ADP. Select the employees who need paper checks. Enter the payment amount. Print the checks using a secure printer. Hand the checks to employees. Make sure to track these checks. This helps in record-keeping. It also ensures employees get paid on time.

Tax Management

ADP Payroll Software helps in calculating taxes with ease. It ensures accurate tax calculations for every employee. The software updates tax rates automatically. This reduces the risk of errors. You can trust the software to handle complex tax calculations. It saves time and avoids manual mistakes.

ADP Payroll Software simplifies filing tax reports. It generates all necessary tax forms. This includes forms for federal, state, and local taxes. You can file these reports directly from the software. The process is quick and efficient. It ensures compliance with all tax laws. This reduces the chance of penalties.

Generating Reports

Payroll reports help you see how much you pay your employees. These reports show wages, taxes, and deductions. They help in checking your budget. They are vital for financial planning. Use these reports to ensure accurate payments. This helps in avoiding mistakes.

Employee reports give details about each worker. You can see work hours, overtime, and leave days. These reports help in managing staff. They ensure fair pay for all. Use them to track performance and attendance. Employee reports are important for HR tasks. They help in making informed decisions.

Credit: ph.adp.com

Troubleshooting And Support

Users often face issues like login problems, slow performance, or incorrect payroll calculations. Check your internet connection first. Clear your browser cache if the software is slow. Incorrect payroll calculations might be due to wrong employee data. Ensure all data is accurate. Also, verify the software settings. Some problems are fixed by simple updates. Always keep your software updated.

If issues persist, contact ADP support. Visit the ADP help center on their website. Use the live chat for quick help. Call their customer service number for urgent problems. Support is available 24/7. They help with technical issues and offer guidance. Always have your account details ready when contacting support. This helps them assist you faster.

Credit: ph.adp.com

Frequently Asked Questions

What Is Adp Payroll Software?

ADP payroll software is a comprehensive solution for managing employee payroll. It automates payroll processing, tax calculations, and compliance. The software simplifies payroll tasks, saves time, and reduces errors.

How Do I Set Up Adp Payroll?

Setting up ADP payroll involves creating an account, entering company details, and adding employees. Follow the guided setup process provided by ADP. Ensure accuracy in employee information and banking details to avoid issues.

Can Adp Handle Tax Calculations?

Yes, ADP payroll software automatically handles tax calculations. It ensures compliance with federal, state, and local tax regulations. The software updates tax rates and rules to maintain accuracy.

Is Adp Payroll User-friendly?

ADP payroll software is designed to be user-friendly. It features an intuitive interface and easy-to-follow instructions. New users can quickly learn and navigate the system without extensive training.

Conclusion

Using ADP Payroll Software simplifies payroll management. It saves time and reduces errors. The platform is user-friendly and efficient. With ADP, managing employee data becomes easier. You can also generate reports quickly. This software supports various payroll needs. Businesses of all sizes can benefit.

Start using ADP Payroll Software today. Improve your payroll process effortlessly.