Managing payroll can be challenging for small business owners. Payroll software can help.

Do It Yourself (DIY) payroll software offers a solution that is both efficient and cost-effective. Free versions of these tools provide essential features without the hefty price tag. They simplify the payroll process, making it easier for businesses to handle their own payroll tasks.

This blog post will explore the benefits of using free DIY payroll software. We’ll also discuss how it can save time and resources. Whether you are a startup or a small business, understanding these tools can help you streamline your payroll process. Let’s dive into the world of free DIY payroll software and see how it can benefit your business.

Credit: technologyadvice.com

Introduction To Diy Payroll Software

DIY payroll software helps manage employee payments. It saves time and money. You can avoid paying for expensive services. The software is easy to use. Accuracy is improved with automated calculations. Compliance with tax laws is ensured. Real-time updates keep you informed. Customization options fit your business needs. Access data anytime, anywhere. Security features protect sensitive information. Many tools offer free versions. This is great for small businesses.

People think DIY payroll is hard. It is not. The software is user-friendly. No special skills needed. Some say it is not secure. This is false. Strong security measures are in place. Others believe it is costly. Many free options are available. Some think it is only for big businesses. Small businesses can benefit too. There is a myth that it lacks support. Most tools offer help and tutorials.

Key Features Of Free Payroll Software

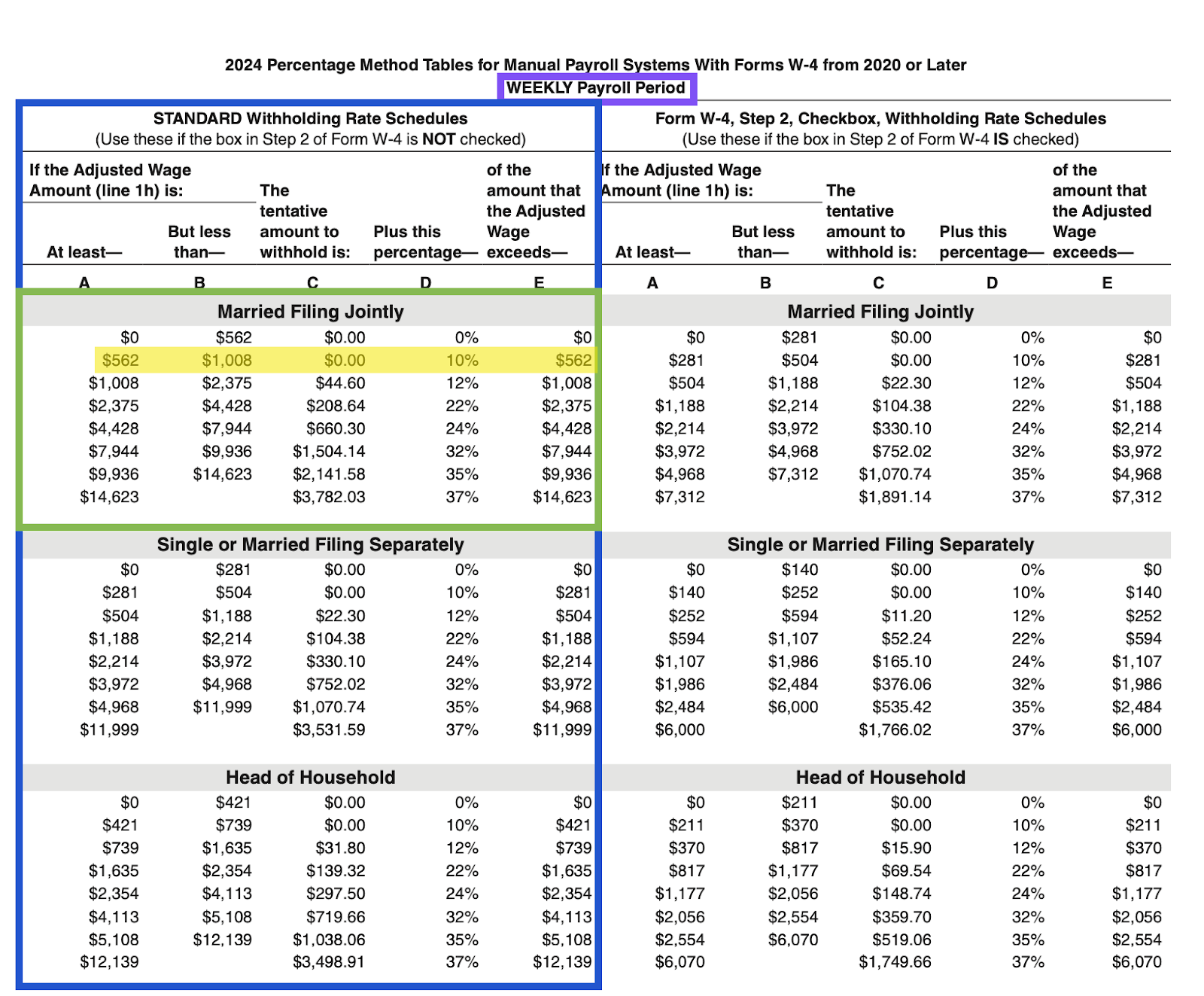

Free payroll software can make payroll calculations easy. It automatically calculates wages, taxes, and other deductions. This saves you time. No need for manual calculations. Mistakes are less likely. Even better, it updates with new rules. So, you always follow the latest guidelines.

Staying tax compliant is simple with these tools. They help you calculate taxes correctly. Reports are generated for you. These tools keep track of changing tax laws. No need to worry about missing updates. This ensures your business follows all tax rules.

Choosing The Right Software

Picking software with a user-friendly interface makes tasks easy. Simple menus and clear instructions help you avoid errors. A clean design means you can find what you need quickly. No need for long training sessions. This saves time and reduces stress.

Good customer support is crucial. Problems can happen anytime. Quick help can keep things running smoothly. Look for software with 24/7 support. Email, phone, or chat options are good. Check reviews to see if support is helpful. Reliable support can save you from big headaches.

Credit: technologyadvice.com

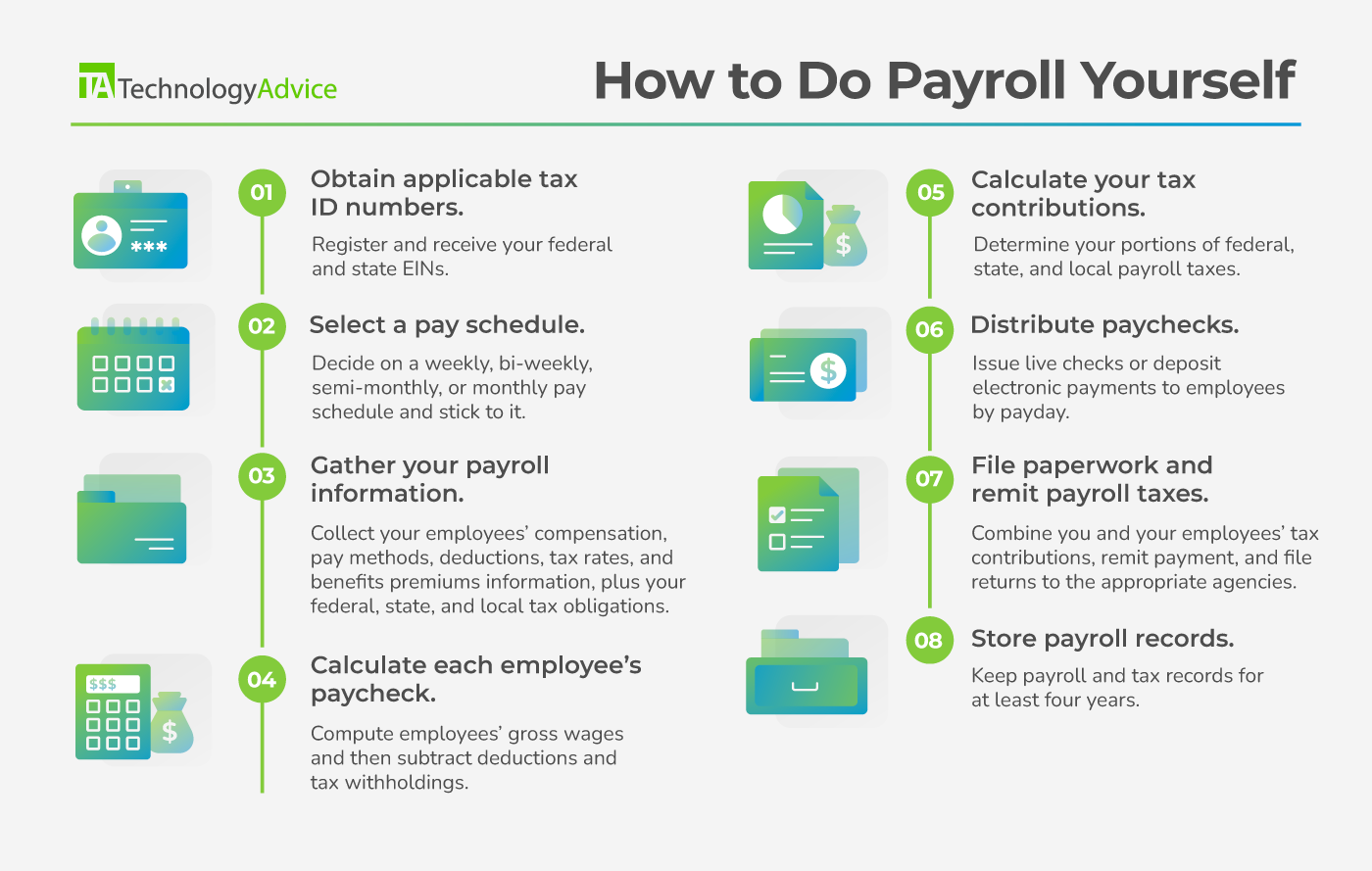

Setting Up Your Payroll System

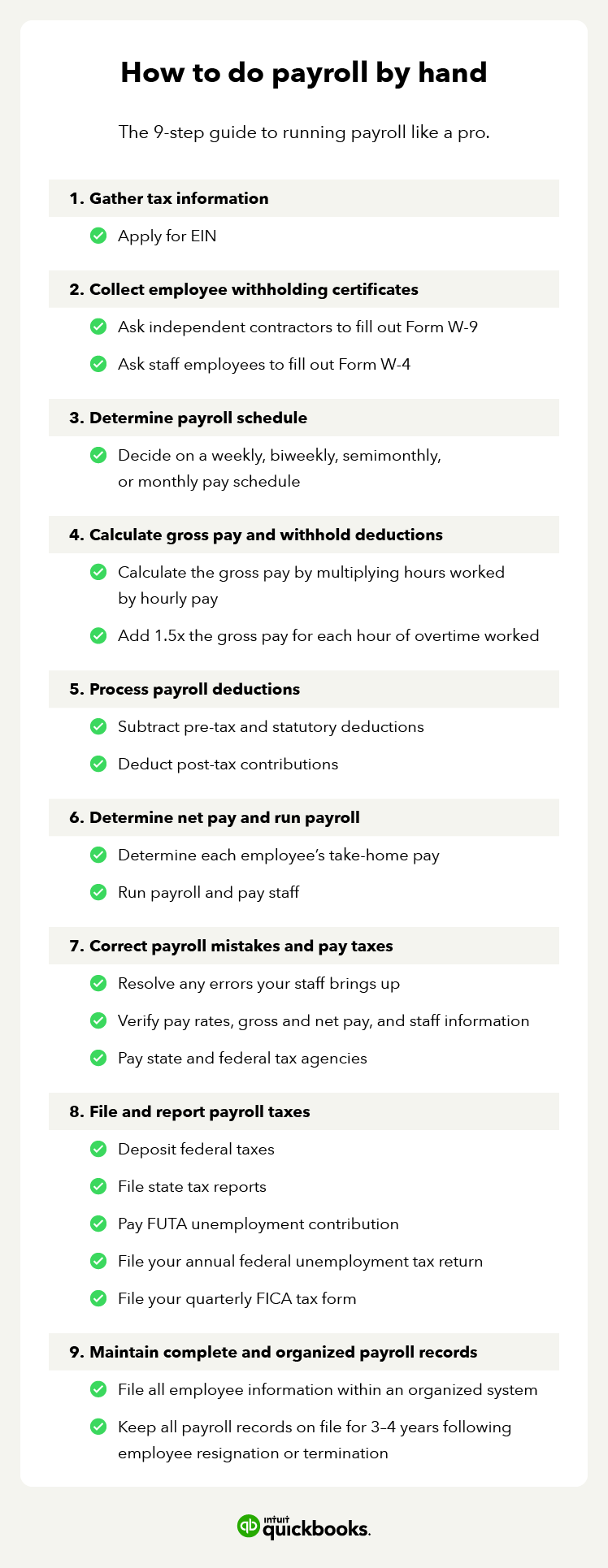

First, gather all employee information. This includes names, addresses, and tax details. Then, choose a payroll schedule. This could be weekly, bi-weekly, or monthly. Next, decide on your payment method. Direct deposit is popular. Checks are another option.

Customize your payroll settings based on your business needs. Set up tax rates. Ensure these are current. Add benefits and deductions. Health insurance and retirement plans are common. Check all settings twice. Accuracy is key for smooth payroll runs.

Managing Employee Information

First, enter the employee’s full name and contact details. Add their job title and department. Next, input their start date and salary details. Make sure to save the information. Review all entries for accuracy.

To update records, select the employee’s name. Edit their details as needed. You can change job titles, departments, and salaries. Ensure to save all updates. Regularly review and update the records. This keeps information accurate and current.

Processing Payroll

Running payroll cycles can be simple. First, collect all employee hours. Next, calculate the pay for each worker. Include overtime if applicable. Then, subtract any deductions. Taxes, benefits, and other withholdings. Finally, prepare to distribute the payments. You can pay by direct deposit or checks.

Pay stubs show details of each payment. They include gross pay, deductions, and net pay. Gross pay is the total before deductions. Net pay is what employees take home. Pay stubs also list hours worked and tax information. You can create pay stubs using templates. Many payroll software options offer free templates. Make sure all information is accurate. Employees rely on these details.

Ensuring Data Security

Data encryption keeps your information safe. It changes data into secret code. Only authorized people can read it. This protects your payroll info from hackers. Always use strong encryption methods. This ensures your data stays protected.

Access controls limit who can see your data. Only trusted people should have access. Use passwords and two-factor authentication. This makes it hard for others to get in. Regularly update your access rules. This keeps your data secure.

Credit: quickbooks.intuit.com

Troubleshooting Common Issues

Calculation errors can be frustrating. Double-check the input data. Ensure all numbers are entered correctly. Look at tax rates and deductions. Make sure they are up to date. Incorrect data can cause problems. Run a test payroll to spot errors. Fix mistakes before finalizing.

Software glitches can occur. Restart the program first. Update the software to the latest version. Check for patches or fixes. Clear temporary files and cache. This can solve minor issues. Contact support if problems continue. They can offer help and guidance.

Maximizing Your Payroll Software

Integrating your payroll software with other tools is very important. It helps to save time and reduce errors. Many payroll tools can connect with accounting software. This makes tracking money easier. You can also link it with HR tools. This helps in managing employee data. Some payroll tools work with time tracking apps. This makes paying employees simpler. Always check if your payroll software can connect with the tools you use. Integration is key to making your work smoother.

Keep your payroll software updated. Updates often fix bugs and improve security. New features are also added in updates. This helps you stay compliant with laws. Updated software can handle changes in tax rules. Always install updates as soon as they are available. This ensures your data is safe. Regular updates also make the software work better. Never skip an update to avoid problems later.

Frequently Asked Questions

What Is Diy Payroll Software?

DIY payroll software allows businesses to manage payroll in-house. It automates calculations, tax filings, and employee payments. This saves time and reduces errors.

Is Free Payroll Software Reliable?

Yes, many free payroll software options are reliable. They offer essential features for small businesses. Always check user reviews and support options.

How To Choose The Best Payroll Software?

Compare features, ease of use, and customer support. Look for software with positive reviews and industry compliance. Trial versions help in decision-making.

Can I Automate Tax Filings With Free Payroll Software?

Many free payroll software options include automated tax filings. This simplifies compliance and reduces manual work. Always verify the software’s tax capabilities.

Conclusion

Choosing a free DIY payroll software can save time and money. These tools offer user-friendly interfaces. They help in managing payroll efficiently. No need for advanced skills. Many businesses benefit from such solutions. Try one today to streamline your payroll tasks.

Enjoy more time for other important work. Simple, effective, and cost-free. It’s a smart choice for any business.