What Is FreshBooks?

FreshBooks is a cloud-based accounting software tailored for small businesses, freelancers, and entrepreneurs. Its mission? To simplify accounting tasks so you can focus on growing your business. From invoicing to expense tracking, it’s a comprehensive tool designed with user-friendliness in mind.

Key Features of FreshBooks in 2025

- Invoicing Made Easy: Customize templates and automate payment reminders.

- Expense Tracking: Snap photos of receipts and categorize expenses effortlessly.

- Time Tracking: Log hours directly into projects for precise billing.

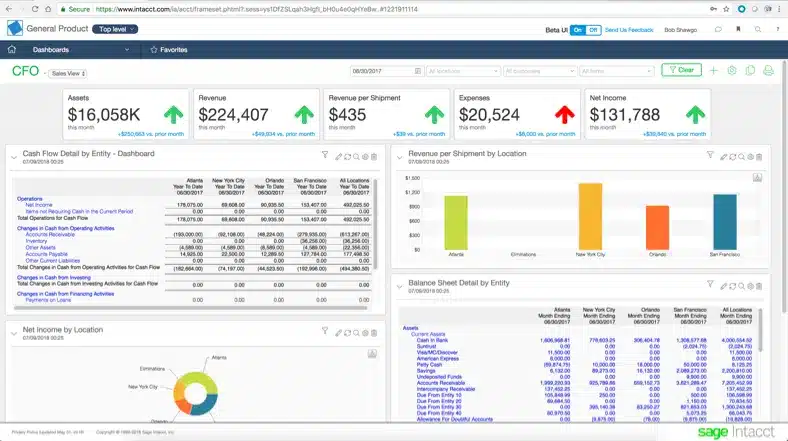

- Financial Reports: Generate profit and loss statements with ease.

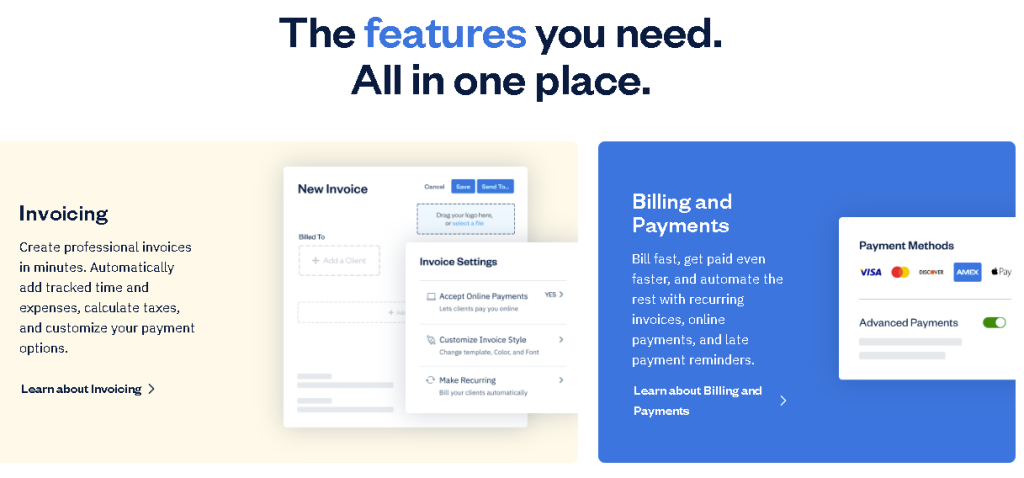

- Payment Integration: Accept payments through various online gateways.

- User-Friendly Mobile App: Manage your finances anywhere, anytime.

FreshBooks 2025: A Step-by-Step Analysis

1. User Interface and Ease of Use

FreshBooks retains its reputation for simplicity with an intuitive, clean dashboard that even non-accountants can navigate effortlessly.

Pros:

- Beginner-friendly interface.

- Quick and easy setup process.

Cons:

- Advanced features may have a learning curve for new users.

2. Invoicing and Payments

FreshBooks excels in invoicing, allowing users to create professional invoices in minutes, automate reminders, and set up recurring payments.

Pros:

- Time-saving automated reminders.

- Support for multiple payment gateways.

Cons:

- Limited customization for complex invoice designs.

3. Expense and Time Tracking

Tracking expenses and billable hours has never been easier. The mobile app lets you snap receipts on the go, while desktop functionality ensures seamless categorization.

Pros:

- Real-time expense syncing.

- Accurate time logging for projects.

Cons:

- Integration with some niche third-party apps could be smoother.

4. Customer Support

FreshBooks is known for its responsive and knowledgeable support team, ready to assist with any questions or issues.

Pros:

- 24/7 email and phone support.

- Comprehensive knowledge base and help center.

Cons:

- Lack of live chat support.

How FreshBooks Compares to Competitors

FreshBooks vs. QuickBooks

- FreshBooks: Best for freelancers and small businesses prioritizing simplicity.

- QuickBooks: Ideal for larger businesses needing advanced features.

FreshBooks vs. Xero

- FreshBooks: Focuses on ease of use and automation.

- Xero: Offers extensive integrations but requires a steeper learning curve.

FreshBooks vs. Wave

- FreshBooks: Paid plans with premium features and customer support.

- Wave: A free option for startups with limited functionality.

Personal Experience with FreshBooks

As a small business owner, I’ve relied on FreshBooks to streamline my invoicing and financial reporting. Its automated reminders alone saved me countless hours chasing payments, and the clear profit and loss statements provided valuable insights. However, I did encounter minor challenges integrating some niche apps, which required creative workarounds.

FAQs About FreshBooks

1. Is FreshBooks suitable for large businesses?

FreshBooks is best for freelancers and small to medium-sized businesses. Larger companies may need more advanced tools like QuickBooks.

2. Does FreshBooks offer a free trial?

Yes, FreshBooks offers a 30-day free trial with access to all features.

3. Can I use FreshBooks for tax filing?

FreshBooks simplifies tax preparation with categorized expenses and tax summary reports. However, final filings may still require an accountant.

4. Is FreshBooks available on mobile?

Absolutely! FreshBooks has a user-friendly mobile app for managing finances on the go.

Conclusion: Is FreshBooks Worth It in 2025?

FreshBooks continues to be a top choice for freelancers and small businesses. Its focus on simplicity, automation, and excellent customer support ensures it remains a trusted tool for financial management. While it may not cater to the complex needs of large enterprises, it excels in delivering value for its target audience.

If you’re ready to simplify your accounting and focus on growing your business, FreshBooks is worth exploring. Start your free trial today and experience the difference!