Accounting for donated software is crucial for nonprofits and businesses alike. It ensures transparency and accurate financial records.

Many organizations receive software donations, but accounting for them can be tricky. You need to understand the value of the software and how to record it in your financial statements. This blog post will guide you through the steps to correctly account for donated software.

We will cover valuation methods, necessary documentation, and the impact on your financial reports. By the end of this post, you will know how to maintain accurate records and stay compliant with accounting standards. Let’s dive into the details and simplify the process of accounting for donated software.

Introduction To Donated Software

Donated software is a valuable asset for many organizations. It helps them save money and access essential tools. Knowing how to account for donated software is crucial. This ensures accurate records and compliance with regulations.

Importance Of Donated Software

Donated software can significantly impact an organization’s operations. Here are a few reasons why it is important:

- Cost savings: Reduces the need for expensive software purchases.

- Access to advanced tools: Provides access to high-quality software.

- Enhanced productivity: Improves efficiency and effectiveness.

- Compliance: Helps meet industry standards and legal requirements.

Understanding the importance of donated software helps organizations appreciate its value. This can lead to better management and utilization.

Common Scenarios

Organizations often encounter different scenarios involving donated software. Here are some common ones:

| Scenario | Description |

|---|---|

| Full Donation | The software is provided for free without any conditions. |

| Conditional Donation | The software is free, but with specific usage conditions. |

| Subscription-Based Donation | The software is free for a limited time or under a subscription model. |

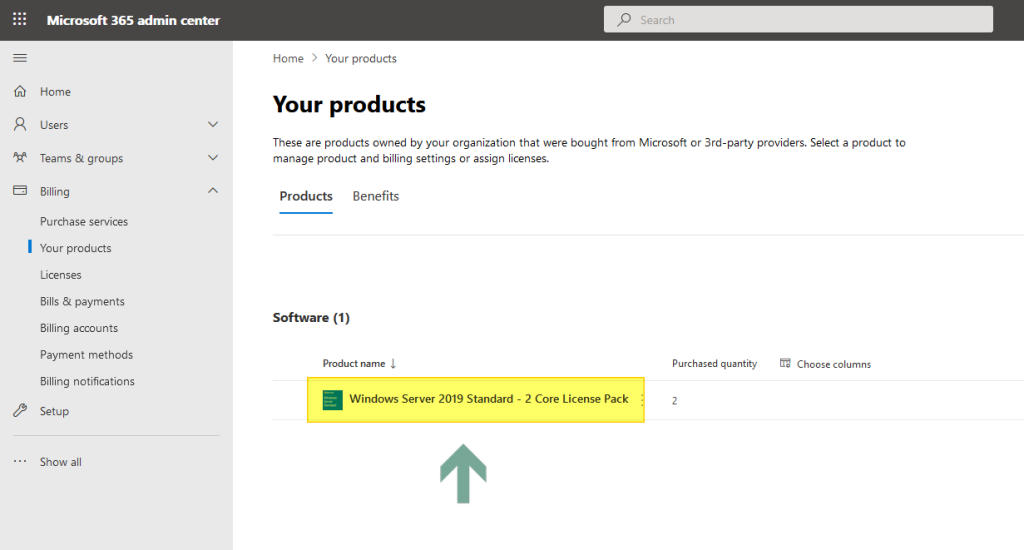

| Licensing Restrictions | The software is free but has limitations on the number of users or installations. |

Each scenario may require different accounting treatments. Properly accounting for these can help maintain accurate financial records.

Credit: www.capterra.ie

Initial Steps For Donated Software

Donated software can be an incredible asset for organizations. Yet, knowing how to account for it is crucial. Proper accounting ensures transparency and helps maintain financial integrity. Let’s explore the initial steps to manage donated software effectively.

Receiving The Donation

First, acknowledge the donation in writing. Send a thank-you letter to the donor. This creates a formal record. Keep all related documents. Store copies of emails or letters that confirm the donation. This documentation is essential for both parties.

Next, update your inventory records. List the software details. Include the name, version, and quantity. Make sure you note the date received. This will help keep track of all donated items.

Assessing Fair Market Value

Determining the fair market value (FMV) of donated software is vital. FMV is the price at which the software would sell in an open market. Research similar software prices online. Check retail prices or consult with software vendors.

If the software is unique or rare, seek expert advice. An appraiser can provide a professional valuation. Document the assessed value thoroughly. This information is important for financial reporting and tax purposes.

Include the FMV in your financial statements. This ensures accurate representation of your assets. Accurate accounting helps build trust with stakeholders and donors.

Recording Donated Software

Donated software can be a great asset for any organization. Properly recording it in your financial records is essential. This ensures transparency and accuracy in your financial statements.

Journal Entries

To record donated software, you need to make specific journal entries. The first step is to determine the fair market value of the software. This value is what you will record in your books.

Here is an example of the journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| MM/DD/YYYY | Software (Asset) | $10,000 | |

| MM/DD/YYYY | Donation Revenue | $10,000 |

In this example, you debit the software account for the fair market value. Then, credit the donation revenue account for the same amount.

Financial Statements Impact

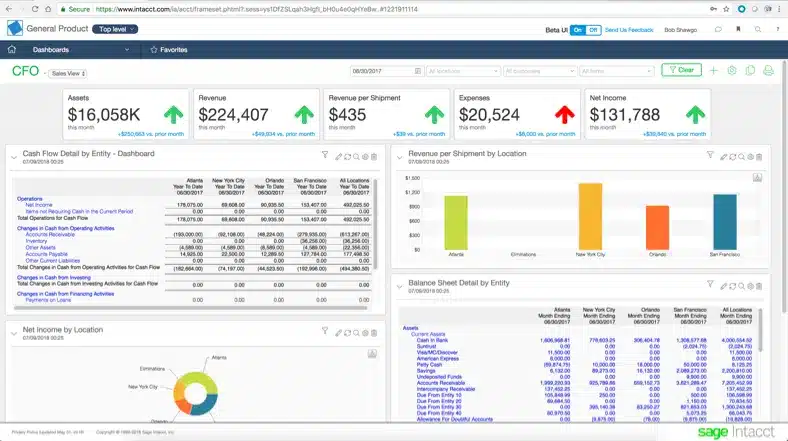

Recording donated software impacts your financial statements. On the balance sheet, the software increases your assets. This shows the value it brings to your organization.

On the income statement, donation revenue increases your total income. This reflects the contribution of the software to your organization’s resources.

These entries ensure your financial records are accurate and complete. They also help in providing a clear picture of your organization’s financial health.

Amortization And Depreciation

Amortization and Depreciation are key concepts in accounting for donated software. These processes help in spreading the cost of software over its useful life. This can be complex but essential for accurate financial reporting. Let’s delve deeper into these concepts.

Useful Life Estimation

Estimating the useful life of donated software is the first step. This is the period over which the software will provide value. Typically, useful life depends on:

- The nature of the software

- Its expected usage

- Technological advancements

For most software, the useful life ranges from three to five years.

Amortization Methods

There are different methods to amortize software costs. The two most common ones are:

- Straight-Line Amortization

- Accelerated Amortization

| Method | Description |

|---|---|

| Straight-Line Amortization | Spreads the cost evenly over the useful life. |

| Accelerated Amortization | Recognizes more expense in the early years. |

Choose the method that aligns with your organization’s financial policies.

Tax Implications

Donated software can greatly benefit organizations. However, understanding the tax implications is crucial. Knowing how to account for donated software ensures compliance and maximizes benefits.

Deductibility

The IRS allows deductions for donated software. The fair market value of the software determines the deduction amount. This value must be assessed at the time of the donation.

To claim a deduction, the donor needs to file IRS Form 8283. This form is necessary for non-cash charitable contributions over $500. The donor must keep detailed records of the donation.

Reporting Requirements

For the recipient, reporting donated software is essential. The organization must record the software as a contribution at its fair market value. This value is also included in the financial statements.

Nonprofit organizations must report these donations on their Form 990. This form provides transparency about the financial health of the organization. Properly accounting for donated software ensures accurate financial reporting.

Credit: www.wikihow.life

Compliance And Regulations

Accounting for donated software involves understanding compliance and regulations. Nonprofits and organizations must follow specific rules. These rules ensure transparency and proper handling of donations.

Gaap Standards

Generally Accepted Accounting Principles (GAAP) set the foundation. They provide guidelines for recording and reporting donations. Under GAAP, donated software must be valued at fair market value. This ensures accurate financial statements.

Nonprofits need to record the donation as revenue. They must also recognize it as an asset. This dual entry keeps the books balanced. It also helps in auditing and financial reviews.

Fasb Guidelines

The Financial Accounting Standards Board (FASB) offers detailed instructions. FASB guidelines complement GAAP standards. They provide clarity on how to value and report donated software. FASB ASC 958-605-25-2 is essential for nonprofits. It specifies recognition criteria for contributions.

According to FASB, organizations must recognize donations when received. If there are donor restrictions, these must be noted. This ensures transparency and compliance with legal requirements.

FASB guidelines also cover in-kind donations. Software donations fall under this category. Accurate valuation and reporting are crucial. It ensures that financial statements reflect true organizational value.

Internal Controls

Internal controls are essential for managing donated software. They ensure accuracy and integrity in accounting. Strong internal controls help prevent misuse and errors. They also provide a clear audit trail. Let’s dive deeper into the key aspects of internal controls.

Documentation Procedures

Documentation procedures are vital. They help track the receipt and use of donated software. Always record the software details. Include the donor’s information, the software’s value, and any usage restrictions.

Keep copies of all related documents. This includes donation letters and software licenses. Proper documentation ensures transparency. It also makes future audits easier.

Audit Trails

An audit trail tracks all transactions. It shows the software’s journey from donation to use. Record every step. Include details about installation, updates, and usage.

Maintain a log of users with access to the software. This helps identify any issues or misuse. An organized audit trail simplifies the review process. It also ensures compliance with regulations.

Case Studies

Understanding how to account for donated software can be challenging. By examining different case studies, we can see how various organizations handle this process. These examples will provide insight into best practices and real-world applications.

Non-profit Organizations

Non-profit organizations often rely on donated software to reduce costs. Proper accounting ensures transparency and compliance with financial regulations. Let’s look at how a local charity managed this:

- Step 1: The charity received a software donation valued at $5,000.

- Step 2: They recorded the donation as revenue in their financial statements.

- Step 3: The software was listed as an asset under the charity’s balance sheet.

- Step 4: Amortization was calculated over the software’s useful life, reducing its value annually.

By following these steps, the charity ensured accurate reporting and maintained the value of the donation in their records.

Educational Institutions

Educational institutions also benefit from donated software, which enhances learning resources. Here’s how a university accounted for their software donation:

| Action | Description |

|---|---|

| Receipt | The university received software valued at $10,000. |

| Recording | The donation was recorded as income in the financial ledger. |

| Asset Recognition | The software was listed as a non-current asset on the balance sheet. |

| Depreciation | Depreciation was calculated over the software’s expected lifespan. |

By documenting each step, the university ensured transparency and compliance with financial standards. This approach also helped in future audits and financial planning.

Credit: www.fidelitycharitable.org

Frequently Asked Questions

What Is Donated Software?

Donated software refers to software provided free of charge by a vendor. It’s often given to non-profits or educational institutions.

How Do I Value Donated Software?

Value donated software based on its fair market value. This is the price it would sell for in an open market.

Is Donated Software Considered Income?

Yes, donated software is considered non-cash income. It must be recorded as a donation at its fair market value.

How Do I Record Donated Software?

Record donated software as both a donation and an expense. This ensures accurate financial reporting and compliance.

Conclusion

Accounting for donated software can seem complex. Follow the steps discussed. Keep records clear and detailed. Check the software’s fair value. Remember, proper documentation is crucial. Consult a professional if needed. With these steps, your accounts will stay accurate. Understanding these basics helps manage your donations better.

Stay organized and compliant.