Payroll software simplifies managing employee salaries. It automates calculations, tax deductions, and payments.

Understanding how payroll software works can save time and reduce errors. Payroll software handles complex tasks, making it an essential tool for businesses of all sizes. It ensures accurate and timely payments, compliance with tax laws, and easy access to payroll data.

This helps businesses maintain employee satisfaction and avoid legal issues. In this post, we will explore the key functions of payroll software, how it processes payroll, and the benefits it offers. By the end, you will have a clear understanding of how payroll software can streamline your payroll management and improve efficiency. Let’s dive in!

Introduction To Payroll Software

Payroll software is vital for businesses. It helps manage employee pay. It ensures accuracy and saves time. Errors can cost money. So, it’s important to get it right. This software keeps records organized.

It also helps with tax calculations. Businesses need to comply with laws. Payroll software updates with new rules. This keeps companies compliant. Employees trust their paycheck. Reliable software builds trust.

Payroll software calculates wages. It also handles deductions. This includes taxes and benefits. It generates payslips for employees. Record-keeping is another key function. It stores past pay data. Easy to access when needed.

Time tracking is often included. This tracks hours worked. Ensures correct pay for hours. Automates many tasks. Reduces manual work. Increases efficiency. Makes life easier for HR teams.

Key Features

Payroll software does automatic calculations for you. It adds up hours worked. It also calculates wages and overtime. This reduces mistakes. You get accurate paychecks every time. No manual work needed.

Tax compliance is very important. The software keeps track of tax rules. It updates automatically. This ensures you always follow the law. It calculates and deducts taxes correctly. It files reports on time. This saves you from fines and penalties.

Benefits For Businesses

Payroll software saves much time. It automates many tasks. No need for manual calculations. Employees get paid faster. Less time spent on payroll means more time for other work.

Manual payroll has many errors. Payroll software reduces mistakes. It calculates everything correctly. It follows all rules and laws. Less risk of fines or penalties. Fewer mistakes mean happier employees.

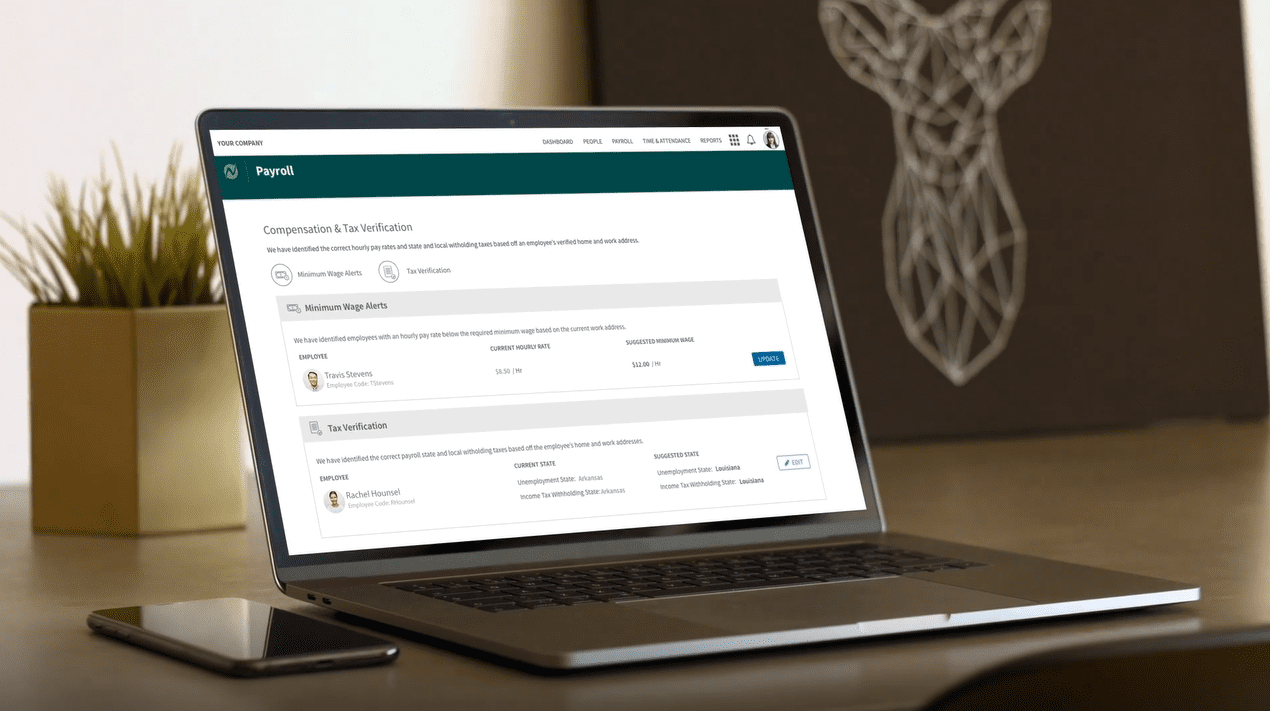

Credit: netchex.com

Integration With Other Systems

Payroll software often links with accounting software. This makes financial tasks easier. Data flows between both systems. Errors reduce. This saves time and effort. Finance teams can see payroll numbers right away. Reports can be created quickly.

HR tools connect well with payroll software. Employee details stay updated. Leave records sync automatically. Managers track work hours easily. Performance data links to pay. All information stays in one place. This helps in smooth operations.

Choosing The Right Software

Payroll software automates salary calculations, tax deductions, and compliance. It ensures timely payments and accurate records, simplifying payroll management.

Identifying Needs

First, understand what your business needs. List down the tasks you want the software to handle. Examples include calculating wages, handling taxes, and generating reports. Think about the number of employees you have. This will help you choose the right plan. Also, consider any specific features you might need. Some businesses need time tracking or direct deposit options.

Evaluating Options

Next, start looking at different software options. Compare their features and prices. Read reviews from other users. Look for software that is easy to use. Check if it offers good customer support. It’s important to have help if you need it. Consider trying a free trial. This way, you can see if it fits your needs before buying.

Implementation Process

Data migration is a crucial step. It involves moving employee data to the new system. This data includes names, addresses, and payment details. Accuracy is very important. Errors can cause payment issues. Double-check all entries. The new system must match the old one. This ensures smooth transition. Backup old data before starting.

Employee training is also key. Staff must learn to use the new software. Training sessions can help. Use simple instructions. Make sure everyone understands. Provide support during the initial phase. Answer questions quickly. Offer manuals and guides. This can help employees feel confident.

Common Challenges

Payroll software can be challenging due to complex tax regulations and constant updates. Managing employee records and ensuring timely payments also pose difficulties.

Data Security

Payroll software stores sensitive information. Employees’ names, addresses, and bank details are at risk. Data breaches can lead to identity theft. Employers must ensure their data is safe. Strong encryption methods protect this data. Regular updates and patches prevent vulnerabilities. Training staff on phishing can help too. Secure access controls are vital. Only trusted employees should access the system.

Compliance Issues

Payroll laws differ by country and state. Staying compliant is a challenge. Payroll software must auto-update to reflect new laws. Incorrect tax filings can lead to penalties. Overtime rules vary and must be followed. Employers must ensure accurate data entry. Regular audits can catch errors early. Compliance also involves proper employee classification. Misclassifying can result in fines.

Credit: wperp.com

Future Of Payroll Software

AI and automation are shaping the future of payroll software. These technologies make tasks faster and easier. With AI, errors in calculations drop. Automation handles repetitive tasks, freeing up time. Chatbots can answer employee questions quickly. Payroll processing becomes smooth and efficient.

Payroll software is evolving globally. Many companies are adopting cloud-based systems. These systems offer flexibility and access from anywhere. Security features are stronger, protecting sensitive data. Mobile access is also becoming common. Employees can check payslips on their phones.

Credit: www.oracle.com

Frequently Asked Questions

What Is Payroll Software?

Payroll software automates employee payment processes. It calculates wages, taxes, and deductions. This ensures accurate and timely payments.

How Does Payroll Software Calculate Taxes?

Payroll software uses current tax rates. It automatically calculates federal, state, and local taxes. This ensures compliance and accuracy.

Can Payroll Software Handle Employee Benefits?

Yes, payroll software manages employee benefits. It tracks health insurance, retirement plans, and other benefits. This simplifies administration.

Is Payroll Software Secure?

Yes, payroll software is secure. It uses encryption and other security measures. This protects sensitive employee information.

Conclusion

Payroll software simplifies managing employee payments. It automates calculations and ensures accuracy. This saves time and reduces errors. Secure, efficient, and user-friendly, it helps businesses stay compliant. Understanding its features can boost productivity. Investing in good payroll software is a smart choice.

It streamlines processes and supports growth. So, explore your options and find the right fit. Your business will benefit greatly.