Need to invoice someone for your software development services? Follow these steps to create a professional invoice.

Invoicing for software development can seem complex, but it doesn’t have to be. Whether you’re a freelancer or a small business, sending clear and accurate invoices is crucial. It ensures you get paid on time and helps maintain good client relationships.

In this guide, we’ll break down the invoicing process step-by-step. From what details to include, to choosing the right format, we’ve got you covered. You’ll learn how to create an invoice that is both professional and easy to understand. Let’s get started on making your invoicing hassle-free.

Setting Up Your Business

Choosing the right business structure is key. It impacts taxes and liability. You can choose to be a sole proprietor. This is simple and easy to start. But, you are personally liable for debts. A partnership is another option. Two or more people share profits and losses. Corporations are more complex. They offer limited liability. Lastly, consider an LLC. It combines benefits of partnerships and corporations.

Registering your business is essential. First, choose a unique name. Check if the name is available. Then, file the necessary paperwork. This varies by location. Get an Employer Identification Number (EIN). It’s like a social security number for your business. Don’t forget to register for state and local taxes. You may also need specific licenses. Check with your local government. Make sure you comply with all regulations.

Understanding Invoicing Basics

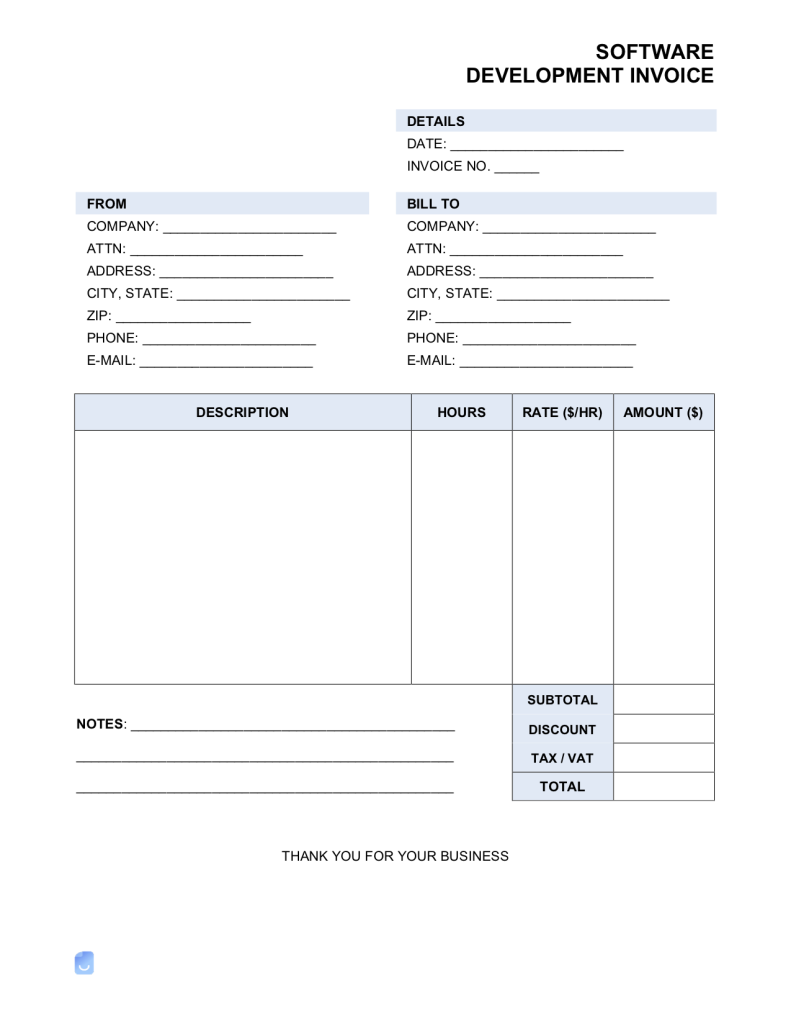

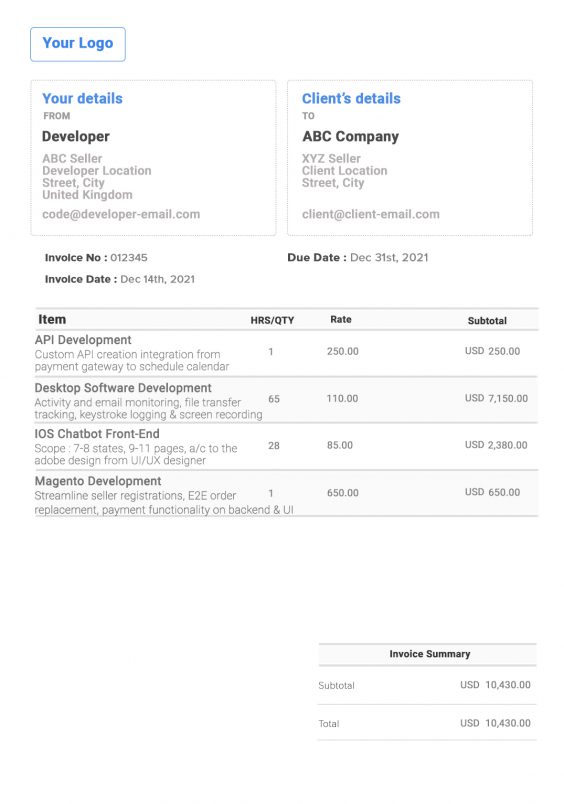

An invoice should have clear details. Include your name, address, and contact information. Add the client’s name and their contact details. Invoice number is very important. It helps track payments. List the services provided. Include hours worked and rate per hour. Mention the total amount due.

Make sure your invoice meets legal standards. Include the date the invoice is issued. Mention the due date for payment. Add tax details if applicable. Some places need a tax ID number. Always keep a copy of the invoice for your records.

Choosing The Right Invoicing Software

There are many invoicing tools available today. Some of the top ones include FreshBooks, QuickBooks, and Zoho Invoice. Each tool has its own unique features and benefits.

FreshBooks is known for its user-friendly interface. QuickBooks offers powerful accounting features. Zoho Invoice provides excellent customization options.

It’s important to look for certain features in invoicing software. These features can make your life easier. Look for tools that offer easy invoice creation and automatic reminders. This can help you get paid on time.

Another useful feature is the ability to track time. This is especially helpful for software developers. Also, look for software with good customer support. This ensures you can get help when needed.

Credit: www.waveapps.com

Creating A Professional Invoice

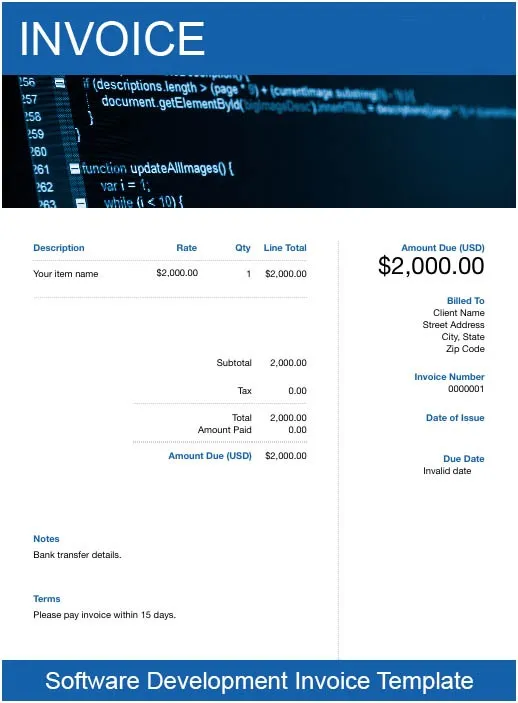

Choose a clear and clean invoice template. Add your logo to make it look professional. Include your company name and contact information. Mention the client’s details clearly. Break down the services provided. Specify the hours worked and rate per hour. Add the total amount due in bold. Include payment terms and due date. Ensure all details are easy to read.

Every invoice must have some key information. Invoice number helps in tracking. Date of invoice is important. Mention the description of services provided. Include the payment method accepted. Provide your tax information if needed. Highlight the total amount at the end. Double-check all details before sending.

Setting Payment Terms

Set a clear date for payment. This helps avoid confusion. Use specific dates, not vague terms. For example, “Payment due by June 15” is better than “Payment due in 30 days”. Clear deadlines help clients plan. They know exactly when to pay you. Always put these dates on your invoices. Remind clients before the due date. Send a friendly email or message. This keeps everyone on track.

Late payments can hurt your cash flow. Set a clear policy for late payments. State this policy on your invoice. For example, “A late fee of 5% will be added after 10 days”. This encourages clients to pay on time. Be consistent with your late fee policy. Always follow through if a payment is late. This shows you mean business. It helps you get paid faster.

Credit: freeinvoicebuilder.com

Handling Taxes And Fees

First, check if you must charge sales tax. This depends on your location. Next, find the correct tax rate. Tax rates can vary. Always stay updated on tax laws. Taxes might change each year. Add the tax amount to your invoice. State the tax rate clearly. It helps clients understand their bill. Keep records of all taxes you charge. This is important for bookkeeping.

Some services come with extra fees. These can be for things like late payments. Decide which fees apply to your services. List these fees in your invoice. Be clear and fair. Clients need to know what they pay for. Keep track of all fees you charge. This helps with your records. Clear records make it easy during tax time.

Sending And Tracking Invoices

Use a clear and simple invoice template. Include your contact details. Add the client’s contact details too. State the services provided. Mention the invoice number and date. Specify the payment terms. Indicate the due date. Ensure all details are accurate. Send the invoice promptly. This helps you get paid on time. Keep a copy for your records. Always be professional in your communication.

Use software to track payments. Mark invoices as paid. Set reminders for due dates. Follow up on overdue payments. Keep records of all transactions. Monitor your cash flow regularly. This helps you stay organized. It also reduces stress. You will always know what is outstanding. And what is already paid.

Dealing With Late Payments

Send a polite reminder after the due date passes. Use clear language. Mention the amount due and due date. Offer payment options in the reminder. Send a second reminder if no response within a week. Be polite but firm.

Consider taking action after multiple reminders. Contact the client by phone. Explain the situation calmly. Offer a payment plan if needed. If no response, consult a lawyer. Send a formal letter demanding payment. Legal action may be necessary.

Credit: www.freshbooks.com

Frequently Asked Questions

How Do I Create An Invoice For Software Development?

Creating an invoice involves detailing services provided, hours worked, and rates. Include your business information, client details, invoice number, and payment terms.

What Should Be Included In A Software Development Invoice?

Include your contact information, client details, a description of services, hours worked, rates, total amount due, and payment terms.

How Do I Send An Invoice To A Client?

Send the invoice via email or through invoicing software. Ensure the client receives and acknowledges the invoice.

When Should I Invoice For Software Development Services?

Invoice after project milestones or upon project completion. Specify payment terms, typically within 30 days.

Conclusion

Creating an invoice for software development doesn’t have to be complex. Just follow the steps outlined. Always include clear details. Specify the work done and the amount due. Use an invoicing tool to make the process easier. Remember, accuracy matters.

Double-check everything before sending. Good invoicing practices build trust. They also ensure you get paid on time. So, keep it simple and professional. Your clients will appreciate it.