Paying for invoice software can seem confusing. But it doesn’t have to be.

Let’s break it down. Invoice software helps manage and streamline your billing process. It’s a tool many businesses rely on to keep things organized and professional. Understanding how to pay for this software can save you time and money.

In this post, we will guide you through paying for invoice software. Whether you are a small business owner or just starting, knowing these steps is crucial. We will cover everything from choosing a payment method to completing the transaction. By the end, you will feel confident and ready to handle your invoice software payments efficiently.

Credit: squareup.com

Choosing The Right Invoice Software

First, understand what your business needs. Do you need features like automatic reminders or custom templates? Think about integration with other tools you use. For example, does it need to work with your accounting software? The size of your business matters too. A small business might need basic features. A large company might need advanced options. List your needs to make the best choice.

| Software | Features | Cost |

|---|---|---|

| QuickBooks | Integration with accounting, Custom templates | $20/month |

| FreshBooks | Automatic reminders, Time tracking | $15/month |

| Xero | Payroll, Expense tracking | $25/month |

Compare the features and costs of each option. This helps you pick the right one. Some software offer free trials. Try them out before buying. Read reviews from other users. Make sure the software fits your business needs.

Credit: invoicemaker.com

Setting Up Your Invoice Software

First, visit the software’s website. Look for the Sign Up button. Click on it. Enter your email address and create a password. Check your email for a confirmation link. Click the link to verify your account. Now, log in with your email and password.

Once logged in, go to Settings. Here, you can set your currency, time zone, and other preferences. Add your company details like name, address, and logo. This helps in making your invoices look professional. Save your changes before exiting.

Adding Clients And Projects

Easily add clients and projects to your invoice software. Streamline your billing process and keep track of payments effortlessly. Simplify your financial management with user-friendly tools.

Entering Client Information

Start by adding client details. Add the client’s name and contact info. This includes their phone number and email address. Ensure all information is correct and up-to-date. Double-check for any spelling errors. Save the client’s information once you are done. This will help when you create invoices.

Setting Up Projects

After adding a client, set up projects. Give each project a unique name. Assign the project to the correct client. Enter the start and end dates for the project. Add a brief description of the project. This helps keep everything organized. Save all details to avoid losing any information.

Credit: invoicehome.com

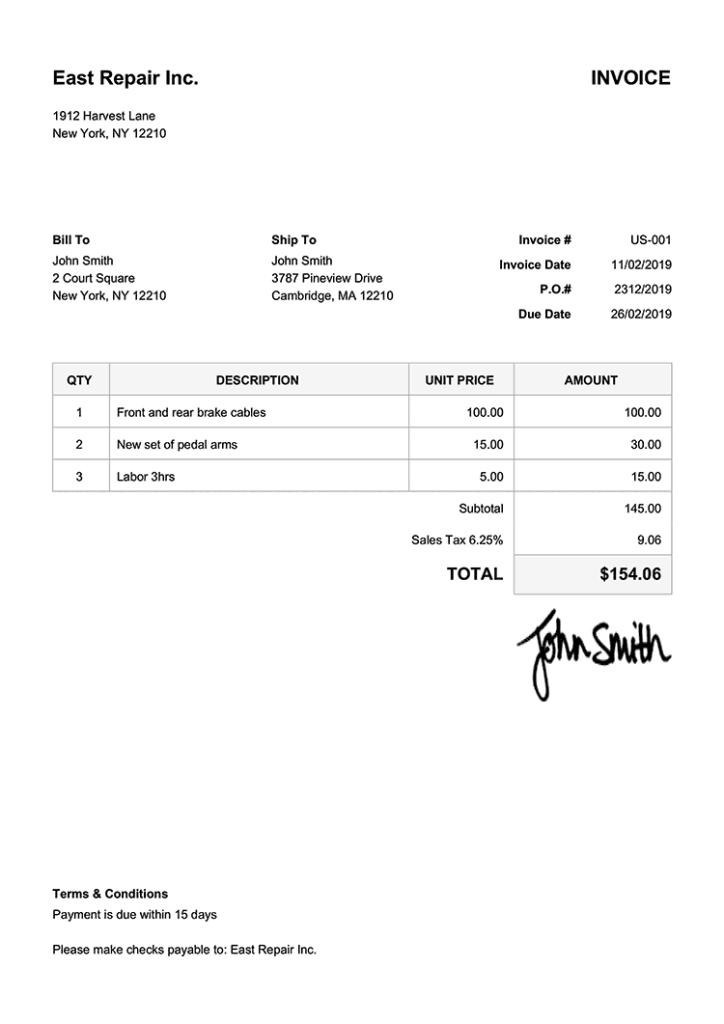

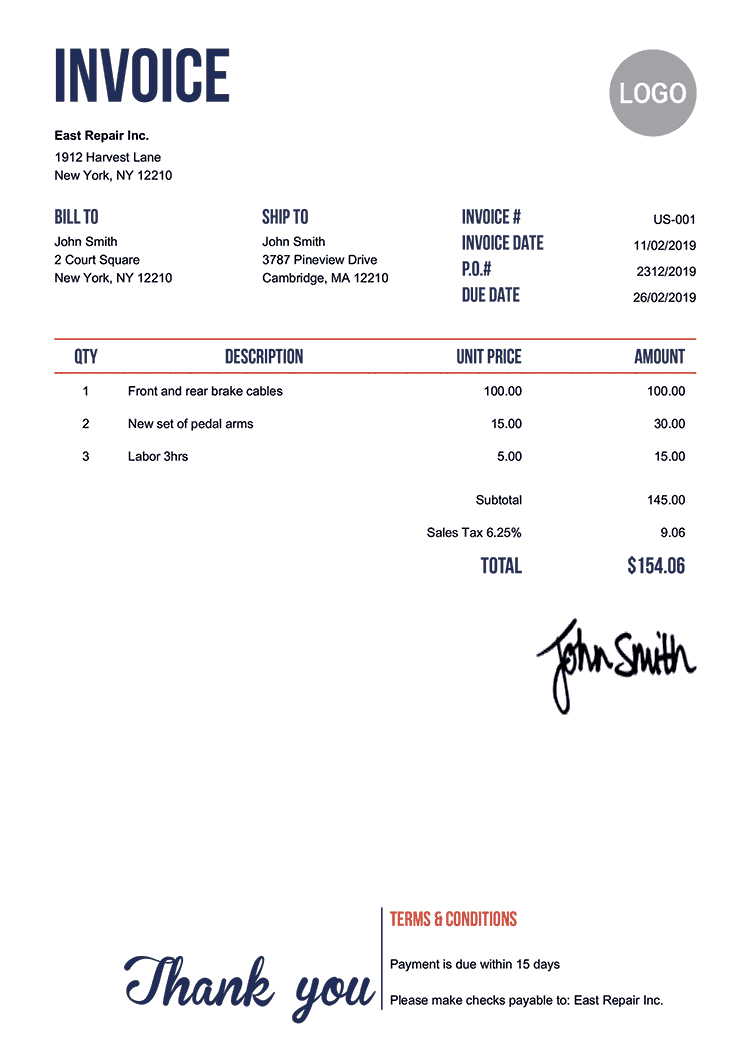

Creating Invoices

Choose a template that suits your business. Ensure it looks professional. Add your logo and company details. Customize colors to match your brand. Include all necessary fields. Make sure to add space for line items. Verify if all details are clear and visible.

List each item or service provided. Mention quantities and unit prices. Calculate the total for each item. Add tax if applicable. Ensure the final amount is accurate. Break down charges for better clarity. Use a table format if needed.

Sending Invoices

Picking the right way to send invoices is important. Email is fast and easy. Mail can be more formal. Hand delivery can add a personal touch. Choose what fits your business best.

Always keep track of sent invoices. Use software to monitor delivery. Check if the client received it. Follow up if needed. This helps avoid payment delays.

Receiving Payments

Choose the best payment methods for your business. You can set up credit cards, bank transfers, and online payment gateways. Make sure to provide clear instructions. This helps customers pay you easily. Verify each payment method works correctly. Test them before going live. This avoids any issues later.

Keep track of all payments received. Use your invoice software to record each payment. Update the status of invoices promptly. This helps you manage your finances better. Check for any missed payments regularly. Follow up with customers if needed.

Managing Overdue Invoices

Setting up automatic reminders helps a lot. It sends emails or messages to clients. This saves time and reduces stress. You can set reminders for different stages. For example, one reminder before the due date and another one after the due date. This ensures clients are aware of their payments.

Dealing with late payments can be tricky. Offer a grace period. This shows understanding and gives clients extra time. If payments are still late, consider adding fees. Late fees can encourage clients to pay on time. Communicate clearly about these fees in your terms.

Generating Financial Reports

Use the software to track all income and expenses. This helps in understanding money flow. It shows where the money is coming from. And where it is going. You can then see patterns in spending. And save money by cutting unnecessary costs. This keeps your business running smoothly. And financially healthy.

Exporting data from the software is easy. You can export to Excel or PDF. Choose the format that suits you best. Keep backups of all exported data. This ensures you never lose important information. Exported data can be shared with others. Or used for further analysis. It makes reporting more flexible and convenient.

Ensuring Data Security

Use strong passwords for software access. Change them every few months. Enable two-factor authentication. It adds an extra layer of security. Always update software to the latest version. This helps fix security flaws. Limit user access to sensitive data. Only authorized users should have access. Encrypt sensitive data to protect it from hackers. Encryption makes data unreadable without a key. Regularly monitor the system for any suspicious activity. Quickly respond to any security breaches.

Perform regular backups of all important data. Store backups in a secure location. Use both on-site and off-site storage. This ensures data safety in case of an emergency. Check backup systems regularly to ensure they work. Test restoration process to confirm data can be recovered. Use automated backup solutions for convenience. They reduce the risk of human error. Keep multiple copies of backups for added safety. Regularly update backup plans to address new risks.

Frequently Asked Questions

What Is Invoice Payment Software?

Invoice payment software automates invoicing and payment processes for businesses. It helps manage billing, track payments, and streamline financial operations.

How Does Invoice Payment Software Work?

Invoice payment software generates, sends, and tracks invoices. It integrates with payment gateways, automates reminders, and records transactions.

What Are The Benefits Of Using Invoice Software?

Invoice software saves time, reduces errors, and improves cash flow. It provides better financial management and enhances customer satisfaction.

Can Invoice Software Integrate With Accounting Systems?

Yes, most invoice software integrates with popular accounting systems. This ensures seamless data transfer and accurate financial records.

Conclusion

Paying invoice software doesn’t have to be difficult. Follow the steps outlined. Choose the best payment method for your needs. Ensure all details are accurate. Keep records of your transactions. This makes bookkeeping easier. Stay organized and avoid late fees.

Take control of your payments now. Your business will thank you.