Using payroll software can simplify managing employee payments. It automates tasks, ensuring accuracy and saving time.

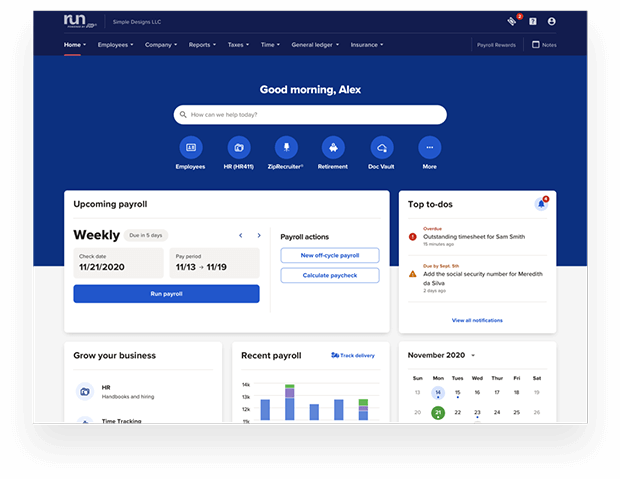

Payroll software is a powerful tool for any business. It handles payroll calculations, tax filings, and compliance. This software minimizes errors and helps keep financial records in order. It offers various features like direct deposits, benefits management, and employee portals.

With these tools, businesses can streamline their payroll process, making it more efficient. In this guide, we’ll explore how to use payroll software effectively. You’ll learn the steps to set it up, run payrolls, and manage employee data. By the end, you’ll feel confident in leveraging this technology to improve your payroll operations.

Introduction To Payroll Software

Payroll software helps businesses manage employee payments. This tool saves time and reduces errors. Small businesses often struggle with payroll tasks. Manual calculations can lead to mistakes. These mistakes cost money and cause stress. Payroll software automates the process. It ensures employees are paid correctly and on time. The software keeps track of hours worked and deductions.

Payroll software offers many benefits. First, it saves time. The software handles complex calculations. This means employees can focus on other tasks. Second, it reduces errors. Mistakes in payroll can be costly. The software ensures accurate payments. Third, it keeps records. These records are important for tax purposes. They help businesses stay compliant with laws. Lastly, it improves efficiency. Faster payroll processing makes employees happy.

Credit: peoplemanagingpeople.com

Choosing The Right Payroll Software

Automation can save time and reduce mistakes. Look for software that automates tax calculations. Check if it can handle direct deposits. Integration with other tools is important. It should work with your accounting software. Some software offers employee self-service. This lets employees view their pay slips.

| Software | Price | Key Features |

|---|---|---|

| Software A | $30/month | Direct deposit, Tax filing, Employee self-service |

| Software B | $25/month | Automated taxes, Integration, Customer support |

| Software C | $20/month | Integration, Reporting, Mobile access |

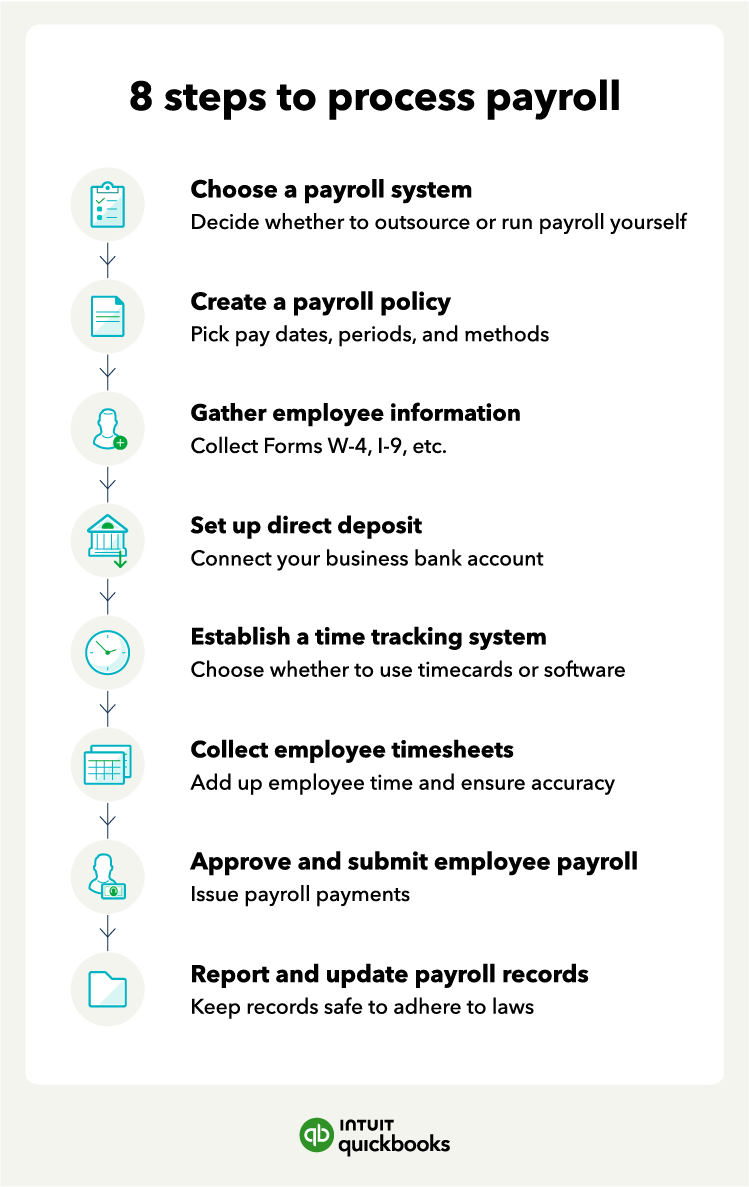

Setting Up Payroll Software

First, download the payroll software. Follow the on-screen steps. Ensure the software is compatible with your system. Enter your company details. This includes name, address, and tax information. Set up user accounts. Assign roles and permissions. Check all settings for accuracy. Regularly update the software. This keeps it secure and efficient.

Check if your current systems are compatible. This includes accounting and HR systems. Link the payroll software with these systems. Use built-in tools or plugins. Test the integration. Ensure data flows smoothly. Correct any issues. This helps in accurate payroll processing. Regularly monitor the integration. Keep all systems updated. This ensures smooth operation.

Inputting Employee Information

Collect basic details. Name, address, and contact info. Gather social security number. This ensures accurate tax calculations. Get bank account details for direct deposit. Collect job title and department. Note hire date and employment type. Gather tax withholding forms. W-4 or W-9, as needed. Ensure all information is accurate.

Open payroll software. Find the “Add Employee” section. Enter name and contact info. Input social security number. Add bank account details. Select job title from the list. Enter hire date and employment type. Fill out tax withholding forms. Double-check for errors. Save the information. Repeat for each employee. Verify all entries before closing.

Processing Payroll

Payroll software makes it easy to calculate salaries. It uses employee data to compute wages. You need to enter hours worked and pay rate. The software will do the rest. It ensures accurate payments to employees. No need for manual calculations. This saves time and reduces errors.

Payroll software can handle deductions too. It calculates taxes, social security, and other withholdings. Just input the necessary information. The software will deduct the correct amounts. It ensures compliance with tax laws. Employees get correct net pay. This keeps everyone happy.

Credit: www.oracle.com

Generating Payroll Reports

Payroll software can create many kinds of reports. These include earnings, taxes, and deductions reports. Each type helps in understanding different parts of payroll. Earnings reports show how much money employees make. Tax reports show how much tax is taken out. Deductions reports show other money taken out, like health insurance.

Reading payroll data is easy. Look at the numbers for each employee. Check their earnings, taxes, and deductions. Make sure all numbers are correct. If something looks wrong, fix it. Correct data helps in making good decisions. It also helps in keeping records clean and accurate. This is very important for any business.

Ensuring Compliance

Payroll software helps ensure compliance by automating tax calculations and record-keeping. It reduces errors and meets legal requirements efficiently.

Understanding Legal Requirements

Payroll software helps in meeting legal rules. Each country has different rules. It’s key to know these laws. This keeps companies safe. Fines can be avoided this way. Software updates help with this. Always use the latest version. This ensures all laws are followed.

Maintaining Accurate Records

Accurate records are crucial. Payroll software makes this easy. All data is stored in one place. Errors are reduced. This saves time. Accurate records mean fewer mistakes. It helps in audits. Reports can be generated quickly. This helps in tracking expenses. Always double-check the entries.

Credit: quickbooks.intuit.com

Troubleshooting Common Issues

Calculation errors can cause big problems. Always double-check the numbers. Make sure all employee data is correct. Incorrect data leads to wrong calculations. Look at the tax codes and deductions. They must be up-to-date. Update the software regularly. This helps prevent errors.

Software glitches can be frustrating. Restart the software first. Sometimes, a simple restart fixes the problem. If not, check for updates. Outdated software often causes glitches. Reinstall the software if needed. This can fix many issues. Contact technical support if problems continue. They have the tools to help.

Future Trends In Payroll Software

Automation is making payroll tasks faster. It reduces human error. AI helps with data analysis. This makes decisions better. AI can predict trends. This saves time and money. Payroll can run smoothly.

More people use phones for work. Payroll software must be mobile-friendly. Employees can check pay on their phones. They can update details easily. Mobile apps are secure. This means data stays safe. Access payroll from anywhere.

Frequently Asked Questions

What Is Payroll Software?

Payroll software is a tool designed to automate and manage employee payments. It handles salary calculations, tax deductions, and other financial aspects. This ensures accurate and timely payments.

How Does Payroll Software Work?

Payroll software works by automating the calculation of employee wages. It considers hours worked, deductions, and taxes. It ensures accuracy and compliance with legal standards.

Why Use Payroll Software?

Using payroll software saves time and reduces errors. It automates complex calculations and ensures compliance with tax laws. It also improves record-keeping and reporting.

What Features Should Payroll Software Have?

Payroll software should have features like automated tax calculations, direct deposit, and compliance management. It should also offer reporting tools and employee self-service options.

Conclusion

Using payroll software can simplify your business operations. It ensures accurate and timely payments. Employees will appreciate the reliability. You save time and reduce errors. Consider integrating payroll software into your processes. It’s an investment in efficiency and peace of mind.

Adopting such tools can lead to smoother workflows. Start exploring your options today. It’s easier than you think.