Finding the right loan management software is crucial for any financial institution. With many options on the market, Loanpro stands out.

In 2025, Loanpro continues to be a popular choice. Its user-friendly interface and advanced features make it a strong competitor. What sets Loanpro apart in the crowded market? This review will explore its key benefits and any potential drawbacks. We will look at its performance, customer support, and overall user satisfaction.

If you’re considering Loanpro for your business, read on to find out if it’s the right fit for you. You’ll get a clear, unbiased view to help make your decision easier.

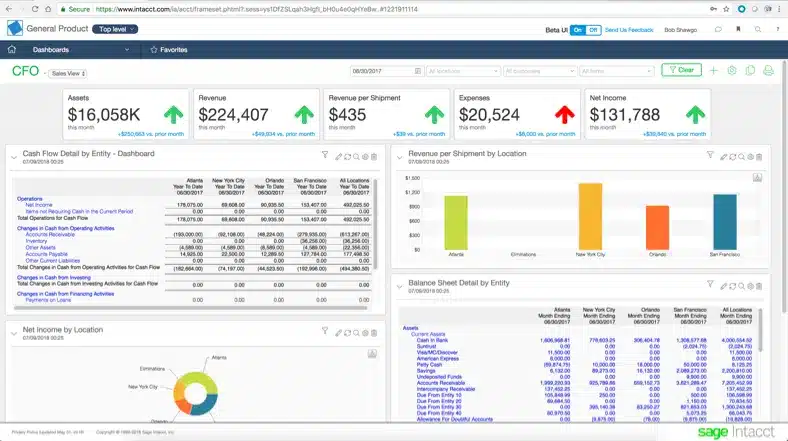

Credit: www.softwareadvice.com.au

Introduction To Loanpro 2025

Loanpro 2025 is the latest version of the popular loan management software. Designed for lenders and financial institutions, it offers powerful tools and features. This software helps manage loans efficiently and effectively.

Loanpro 2025 aims to simplify the loan management process. It provides an intuitive interface and advanced features. Users can expect improved performance and better results.

What Is Loanpro?

Loanpro is a comprehensive loan management software. It supports various types of loans, including personal, auto, and mortgage loans. The software streamlines the lending process from start to finish.

Loanpro helps lenders track and manage loans with ease. It offers tools for loan origination, servicing, and collections. This makes the entire loan lifecycle simpler and more efficient.

Pros of LoanPro

✅ User-Friendly with Powerful Features – LoanPro provides a clean interface and a wide range of functionalities to help lenders manage loans efficiently.

✅ Automation Saves Time – The platform automates repetitive tasks, reducing manual work and improving accuracy.

✅ Excellent Customer Support – Many users praise LoanPro’s support team for being responsive and helpful.

✅ Highly Customizable – Lenders can tailor the system to their specific needs, making it a flexible solution for different loan types.

Cons of LoanPro

❌ Steep Learning Curve – Some users report that the onboarding process is complex and requires time to master.

Key Features

Loanpro 2025 comes packed with key features. These features enhance the user experience and improve loan management.

One key feature is the user-friendly interface. It is designed to be easy to navigate and use. This makes it accessible to users of all skill levels.

Another important feature is the automation tools. Loanpro 2025 automates many tasks in the loan management process. This saves time and reduces human error.

Additionally, the software offers robust reporting capabilities. Users can generate detailed reports on loan performance. This helps lenders make informed decisions.

Loanpro 2025 also includes advanced security measures. These measures protect sensitive data and ensure compliance with regulations. Users can trust that their information is safe and secure.

User Experience

Loanpro Reviews 2025 highlights key aspects of the user experience. The platform aims to provide a seamless and intuitive experience for all users. Whether you are a beginner or an experienced user, Loanpro offers features that cater to your needs. Let’s dive into the specifics of user experience under Ease of Use and Customer Support.

Ease Of Use

Loanpro’s interface is straightforward and user-friendly. Users can navigate through the platform without confusion. The dashboard is clean and well-organized. This allows users to find tools and features quickly. Customization options are available to fit individual preferences. Users can set up their accounts and start using Loanpro efficiently.

Customer Support

Loanpro offers robust customer support. Users can access help through multiple channels. Live chat, email support, and a detailed FAQ section are available. The support team is responsive and knowledgeable. They provide timely and accurate solutions. This ensures users have a positive experience when they need help.

Performance And Reliability

When selecting loan management software, performance and reliability are essential. Loanpro Reviews 2025 provides insights into how this software stands in these critical areas. This section will cover uptime, downtime, speed, and efficiency.

Uptime And Downtime

Uptime is crucial for any software. Loanpro boasts an impressive uptime record. Users report minimal interruptions. This reliability ensures smooth operations.

Downtime can disrupt business. Loanpro keeps downtime to a minimum. Scheduled maintenance is communicated clearly. Users know when to expect brief outages. This transparency is appreciated by many.

Speed And Efficiency

Loan management requires quick processing. Loanpro excels in speed. Tasks are completed rapidly. This efficiency saves users valuable time.

Efficiency goes beyond speed. Loanpro optimizes resource usage. This reduces costs and improves performance. Users notice faster response times. This leads to higher satisfaction levels.

Pricing And Plans

Loanpro offers various pricing and plans for its services. Understanding these options helps users choose the right plan for their needs. This section covers subscription options and evaluates the cost versus value of Loanpro’s services.

Subscription Options

Loanpro provides multiple subscription options. These cater to different user requirements and budgets. Users can select from basic, standard, and premium plans. Each plan offers unique features and support levels.

The basic plan covers essential features. It suits small businesses and startups. The standard plan offers more advanced tools and integrations. It is ideal for growing businesses. The premium plan provides the most comprehensive features and personalized support. This plan targets large enterprises with complex needs.

Cost Vs. Value

Evaluating cost versus value is crucial. Loanpro aims to provide competitive pricing while delivering high value. The basic plan is affordable and offers essential tools. It is perfect for those on a tight budget.

The standard plan, though pricier, includes more advanced features. These tools can improve efficiency and save time. Thus, the extra cost is justified. The premium plan, while the most expensive, offers extensive features and dedicated support. This plan ensures businesses get maximum value and support.

In summary, Loanpro’s pricing aligns with the value provided. Users can choose a plan that fits their budget and needs. This flexibility makes Loanpro a popular choice among businesses of all sizes.

Security Measures

Loanpro Reviews 2025 highlights various aspects of the platform, with security measures being a significant focus. Understanding how Loanpro ensures the security of its users’ data is crucial. Let’s dive into the specific security measures that Loanpro implements.

Data Protection

Loanpro prioritizes data protection to safeguard user information. They use advanced encryption methods to secure data. This means your data remains safe from unauthorized access. Regular security audits help identify potential vulnerabilities. These audits ensure that all data stays protected at all times.

Compliance Standards

Loanpro adheres to strict compliance standards. They follow industry regulations to maintain high security levels. Compliance with these standards ensures that user data is handled responsibly. This commitment to compliance builds trust with their users.

Regular updates to their security protocols keep them in line with current standards. This proactive approach ensures ongoing protection for all users.

Integration Capabilities

Integration capabilities are a critical feature in modern loan management systems. Loanpro Reviews 2025 highlights the robust integration options available. This ensures seamless operations and enhances overall efficiency.

Third-party Integrations

Loanpro offers a wide range of third-party integrations. These integrations help you connect with various external platforms. You can easily link your Loanpro account with popular tools like QuickBooks, Salesforce, and Zendesk.

This integration capability allows for smooth data flow between different systems. It reduces manual data entry and minimizes errors. The system supports payment gateways, CRM systems, and accounting software. This ensures that all your essential tools work together efficiently.

Api Availability

The availability of a powerful API is another highlight of Loanpro. The API allows developers to build custom integrations. It provides flexibility and control over how you manage your data.

The API documentation is comprehensive and easy to understand. This ensures that even those with basic coding skills can use it. Here is a summary of the API features:

| Feature | Details |

|---|---|

| Endpoints | Multiple endpoints for various operations |

| Authentication | Secure OAuth2.0 authentication |

| Rate Limits | High rate limits for smooth operations |

| Documentation | Clear and detailed documentation |

These API features make Loanpro a versatile and scalable solution. It can adapt to your unique business needs.

User Ratings And Feedback

Understanding user ratings and feedback is essential to evaluate any software. Loanpro Reviews 2025 brings a mix of positive and negative experiences from its users. This section dives into what users are saying, highlighting both praise and complaints.

Positive Reviews

Users appreciate Loanpro for its user-friendly interface and robust features. Many find it easy to navigate and efficient for managing loans. Here are some of the positive points highlighted by users:

- Intuitive Design: The platform’s design is simple and intuitive. Users can easily find the tools they need.

- Comprehensive Reporting: Detailed reports help users track and analyze their loan portfolios effectively.

- Customer Support: Users praise the responsive and helpful customer support team.

Common Complaints

Even with positive feedback, some users have raised concerns. Here are the common complaints:

- Performance Issues: Some users experience slow load times. This affects their efficiency.

- Complex Features: A few users find some advanced features difficult to use. They require more training.

- Price: Some feel the software is expensive compared to its competitors.

Overall, Loanpro Reviews 2025 reflects a balance of positive experiences and areas for improvement. Understanding these can help potential users make an informed decision.

Credit: www.getapp.com

Comparison With Competitors

LoanPro has carved a niche in the lending software market. Yet, many wonder how it stacks up against its competitors. This comparison will shed light on LoanPro’s strengths and weaknesses, and its market position.

Strengths And Weaknesses

Strengths:

- User-Friendly Interface: LoanPro offers an easy-to-navigate interface.

- Customization: Users can tailor the software to their specific needs.

- Customer Support: LoanPro provides robust support services.

- Integration: The software integrates with various third-party platforms.

Weaknesses:

- Price: LoanPro’s pricing may be steep for small businesses.

- Learning Curve: Some users find it challenging to learn initially.

- Limited Free Trial: The free trial period is shorter than some competitors.

Market Position

LoanPro holds a solid position in the lending software market. It is recognized for its reliability and innovation. Below is a comparison table that highlights LoanPro’s market position against its main competitors.

| Feature | LoanPro | Competitor A | Competitor B |

|---|---|---|---|

| User-Friendly Interface | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Customization | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Customer Support | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Integration | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Price | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

LoanPro excels in customization and customer support, but its price could be a concern. Competitors offer strong alternatives, but LoanPro remains a top choice for many.

Conclusion And Final Thoughts

Loanpro Reviews 2025 provides valuable insights into the platform’s performance. Users appreciate the robust features and reliable service. Let’s dive into our overall impression and future outlook.

Overall Impression

Loanpro stands out for its user-friendly interface. Many users find it intuitive and easy to navigate. The platform offers comprehensive tools for managing loans. This streamlines the lending process effectively. Customer support receives high marks for prompt assistance. Users feel supported and valued.

The security measures are top-notch. Users trust their data is safe. The platform’s performance is consistent. It handles large volumes efficiently. Loanpro proves to be a dependable solution. Users are generally satisfied with their experience. The feedback is overwhelmingly positive.

Future Outlook

Loanpro shows promise for the future. Users expect more innovative features. The platform is likely to evolve with user needs. Continuous updates will keep it relevant. The company appears committed to growth. This is encouraging for current users.

Expanding integration options is a key focus. This will enhance the platform’s versatility. Users anticipate improvements in automation. This could further simplify loan management. The future looks bright for Loanpro. Users are optimistic about what’s ahead.

Credit: www.facebook.com

Frequently Asked Questions

What Is Loanpro?

Loanpro is a loan management software. It helps businesses manage loans efficiently.

How Does Loanpro Work?

Loanpro automates loan processes. It handles loan applications, payments, and collections.

Is Loanpro Easy To Use?

Yes, Loanpro has a user-friendly interface. It’s designed for ease of use.

Can Loanpro Integrate With Other Software?

Yes, Loanpro integrates with many other software. This improves workflow and data management.

What Industries Use Loanpro?

Loanpro is used in various industries. Financial institutions, auto lenders, and real estate companies use it.

Does Loanpro Offer Customer Support?

Yes, Loanpro provides customer support. They offer help via phone, email, and live chat.

Is Loanpro Secure?

Yes, Loanpro uses advanced security measures. It ensures your data is safe and protected.

What Are The Benefits Of Using Loanpro?

Loanpro saves time and reduces errors. It automates loan management and improves efficiency.

Conclusion

Loanpro Reviews 2025 highlight the platform’s efficiency and user-friendly features. It stands out for its reliable performance and adaptability. Users appreciate its seamless integration and robust support system. Loanpro continues to innovate, meeting the evolving needs of its users. Its intuitive design makes managing loans simpler.

This platform remains a solid choice for businesses seeking streamlined loan management. Positive feedback from users reinforces its credibility. Consider Loanpro for a dependable loan management solution in 2025. It offers value and efficiency, making it a strong contender in the market.