PayPal Invoicing helps businesses get paid faster. It’s an easy and secure way to manage invoices online.

In today’s digital age, efficiency is key for any business. PayPal Invoicing offers a streamlined solution for handling payments. Businesses can create, send, and track invoices with just a few clicks. This tool eliminates the hassle of traditional paper invoices.

It ensures timely payments, which is crucial for maintaining cash flow. PayPal Invoicing is also user-friendly, making it accessible to everyone, even those without tech skills. Whether you are a small business owner or a freelancer, this service can save you time and effort. Dive in to learn how PayPal Invoicing can benefit your business.

Credit: www.angelleye.com

Introduction To Paypal Invoicing

PayPal Invoicing is a powerful tool for businesses of all sizes. It helps streamline payment processes and ensures timely payments. This tool is part of PayPal’s extensive suite of features designed to simplify financial transactions. In this section, we will explore what PayPal Invoicing is and the benefits it offers.

What Is Paypal Invoicing?

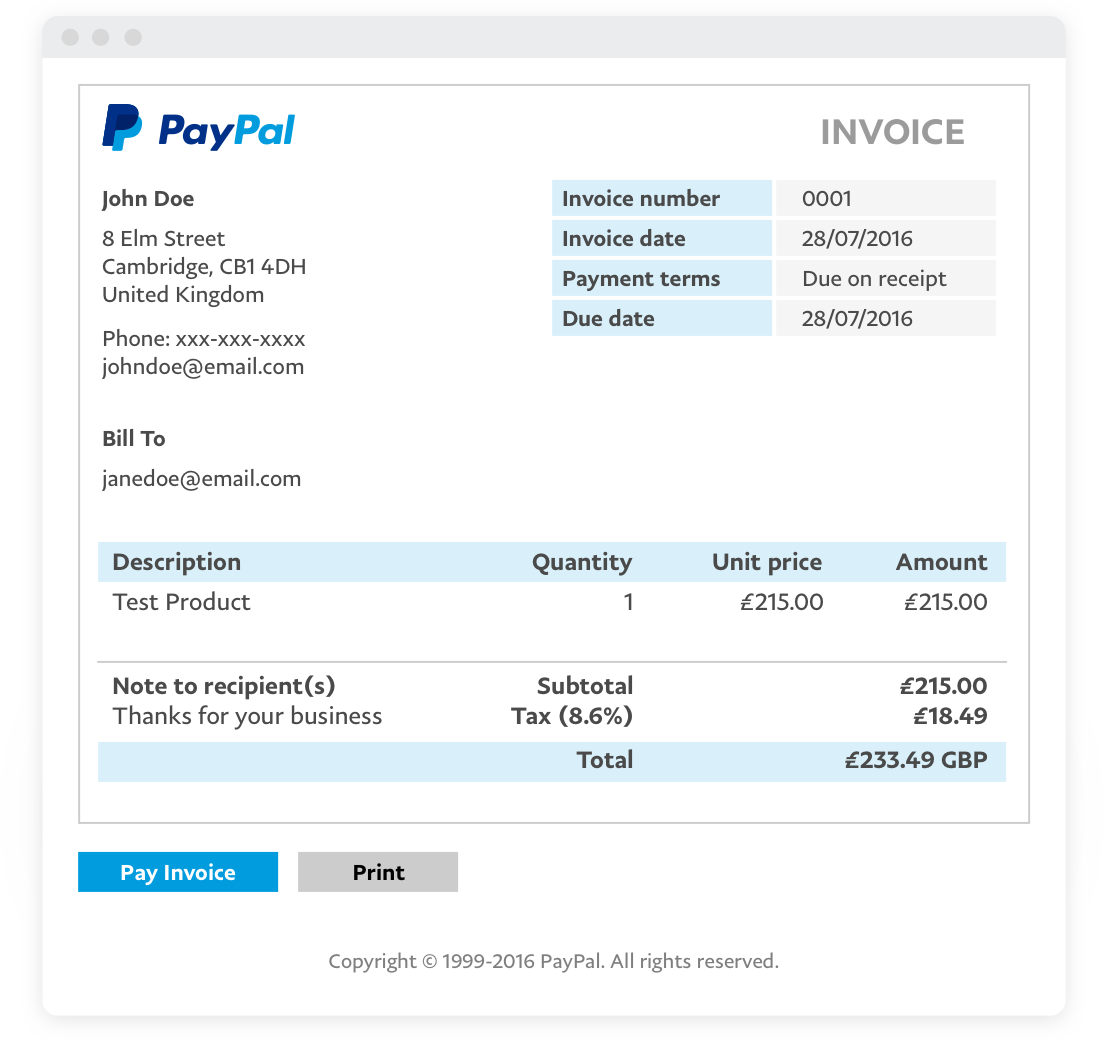

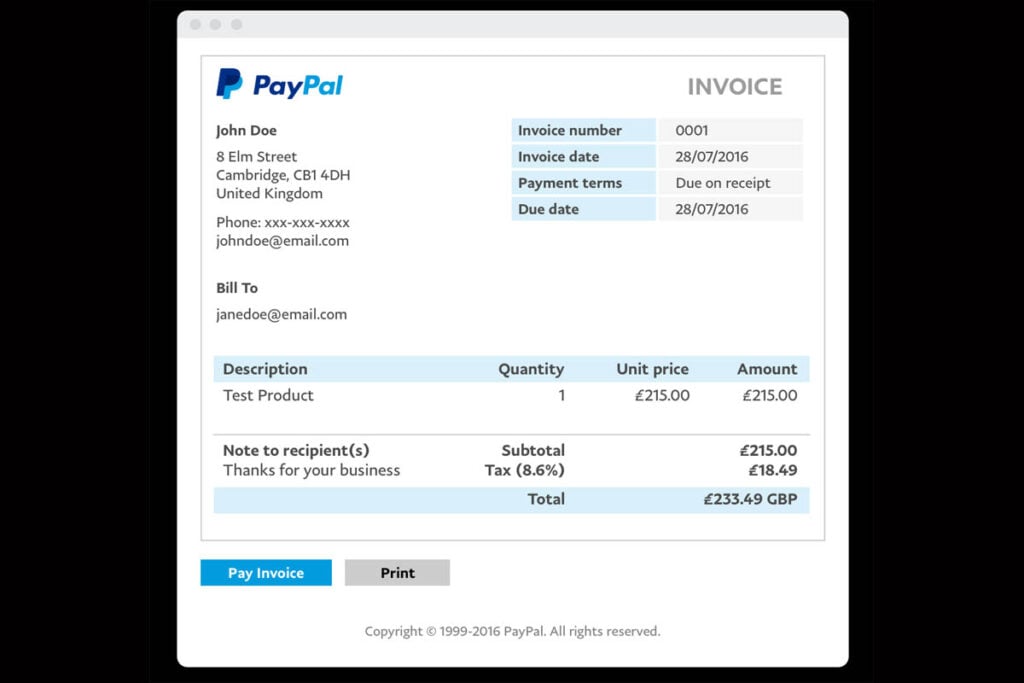

PayPal Invoicing allows businesses to create and send professional invoices. It is integrated with the PayPal platform, making it easy to manage payments. You can customize invoices with your logo and business details. This feature supports multiple languages and currencies, making it suitable for global transactions.

Creating an invoice is simple. Log into your PayPal account, go to the “Invoicing” section, and click “Create Invoice.” Fill in the necessary details such as recipient email, item description, and amount. Once done, send the invoice directly from PayPal. The recipient can pay using various payment methods, including credit cards and PayPal balance.

Benefits Of Using Paypal Invoicing

Using PayPal Invoicing offers several advantages:

- Ease of Use: The interface is user-friendly and intuitive.

- Professional Appearance: Invoices look polished and can include your branding.

- Global Reach: Supports multiple languages and currencies.

- Quick Payments: Clients can pay instantly using various methods.

- Tracking: Track the status of invoices and receive notifications.

- Integration: Seamlessly integrates with PayPal’s other services.

To summarize the benefits, here is a quick comparison table:

| Benefit | Description |

|---|---|

| Ease of Use | User-friendly and intuitive interface. |

| Professional Appearance | Invoices include your branding and look polished. |

| Global Reach | Supports multiple languages and currencies. |

| Quick Payments | Clients can pay instantly using various methods. |

| Tracking | Track invoice status and receive notifications. |

| Integration | Seamlessly integrates with PayPal’s other services. |

Setting Up Your Paypal Account

Getting started with PayPal Invoicing is simple. First, you need to set up your PayPal account. This step-by-step guide will help you create a PayPal Business Account and verify it. Let’s dive in!

Creating A Paypal Business Account

Follow these steps to create a PayPal Business Account:

- Go to the PayPal website.

- Click on “Sign Up” at the top right corner.

- Select “Business Account” and click “Next”.

- Enter your email address and create a password.

- Fill in your business details, such as name, address, and phone number.

- Click “Agree and Create Account”.

Your PayPal Business Account is now created. Next, you need to verify your account to start using all features.

Verifying Your Account

Verification adds security and trust to your account. Here’s how to verify your PayPal account:

- Log in to your PayPal account.

- Go to “Settings” (the gear icon).

- Click on “Account Settings”.

- Under “Business Information”, click “Update”.

- Follow the prompts to provide necessary information:

- Link your bank account.

- Confirm your email address.

- Provide business identification documents.

Once verified, you can send and receive payments without limits. You are now ready to create and send invoices with PayPal.

Creating And Customizing Invoices

Creating and customizing invoices with PayPal is quick and straightforward. This guide will walk you through the process of generating invoices step-by-step and show you how to personalize invoice templates to meet your business needs.

Step-by-step Invoice Creation

Follow these steps to create an invoice on PayPal:

- Log in: Access your PayPal account and navigate to the “Send & Request” tab.

- Select Invoice: Click on the “Create Invoice” button.

- Fill in Details: Enter your client’s email address, item details, and amount.

- Review: Double-check all the information for accuracy.

- Send: Click “Send” to deliver the invoice to your client.

This simple process ensures that your invoicing is efficient and professional.

Customizing Invoice Templates

PayPal allows you to customize invoice templates to match your brand identity. Here’s how:

- Access Templates: Go to the “Invoice Settings” under the “Manage Invoices” section.

- Edit Template: Click on “Customise” next to the template you want to modify.

- Add Logo: Upload your business logo for a professional touch.

- Choose Colors: Select colors that match your brand.

- Customize Fields: Modify invoice fields to include necessary information such as tax ID or business address.

- Save: Save your customized template for future use.

Customizing invoices helps in maintaining consistent branding and adds a professional look to your business communications.

Managing Your Invoices

Managing your invoices effectively is crucial for maintaining a healthy cash flow. PayPal Invoicing offers a range of tools to help you stay organized. With its user-friendly interface, you can track invoice statuses, send reminders, and ensure timely payments. This section will guide you through the essentials of managing your invoices with PayPal.

Tracking Invoice Status

Keeping an eye on your invoices is essential. PayPal makes it easy to track the status of each invoice. You can see whether it is sent, viewed, or paid. This information helps you understand the progress of your transactions. To view the status:

- Log in to your PayPal account.

- Go to the Invoicing section.

- Select the invoice you want to track.

The status will be displayed next to each invoice. This feature helps you stay updated without much effort. It also allows you to take timely actions if needed.

Sending Reminders

Sending reminders is a key feature of PayPal Invoicing. It helps ensure timely payments. If an invoice is overdue, you can send a polite reminder. Here’s how to send a reminder:

- Log in to your PayPal account.

- Navigate to the Invoicing section.

- Select the overdue invoice.

- Click on Send Reminder.

You can customize the reminder message. This adds a personal touch and improves the chances of receiving prompt payment. Reminders keep your clients informed and help maintain a good relationship.

Managing your invoices effectively ensures a smooth cash flow. Use PayPal’s features to track statuses and send reminders efficiently.

Payment Collection Options

PayPal Invoicing offers various payment collection options. These options simplify the process for businesses and customers. By using PayPal Invoicing, you can enjoy flexibility and convenience in collecting payments. Let’s explore some of these options.

Accepting Multiple Payment Methods

PayPal Invoicing allows you to accept multiple payment methods. Customers can pay using their PayPal account, credit cards, or debit cards. This flexibility helps you cater to different customer preferences. It can also increase the chances of getting paid faster.

Offering various payment methods can improve customer satisfaction. It shows that you value their convenience. This can lead to repeat business and positive reviews.

Integrating Paypal With Other Platforms

PayPal can integrate with many other platforms. You can link it with your e-commerce site, accounting software, or CRM system. This integration makes it easier to manage invoices and payments. It can save you time and reduce errors.

Using these integrations, you can automate many tasks. For example, you can set up automatic reminders for unpaid invoices. This ensures that you get paid on time without extra effort. It also helps keep your records up-to-date and accurate.

Credit: www.paypal.com

Security And Fraud Prevention

Security and fraud prevention are essential parts of any online payment system. Paypal Invoicing offers robust security features and fraud prevention measures. These ensure that your transactions are safe and your data is secure.

Ensuring Secure Transactions

Paypal uses advanced encryption technology to protect your information. Your data is always encrypted during transactions. This prevents unauthorized access to sensitive information.

Paypal also offers two-factor authentication. This adds an extra layer of security. Users must verify their identity using a second method, like a mobile device. This makes it harder for fraudsters to access your account.

Another feature is transaction monitoring. Paypal monitors all transactions for suspicious activity. Any unusual transactions are flagged and reviewed. This helps to quickly identify and stop fraud.

Identifying And Avoiding Fraud

Paypal provides tools to help you identify fraudulent activities. For example, you can review the details of an invoice before paying. Look for any unusual or unexpected charges.

It is also important to verify the sender’s information. Ensure the email address and company name are correct. If something looks off, contact the sender directly to verify.

Paypal also offers buyer and seller protection. This helps protect against fraud and scams. If you receive an item that is significantly different from the description, you can open a dispute. Paypal will review the case and may issue a refund.

| Security Feature | Description |

|---|---|

| Encryption | Protects your data during transactions. |

| Two-Factor Authentication | Requires a second verification method. |

| Transaction Monitoring | Flags and reviews suspicious activity. |

| Buyer and Seller Protection | Helps resolve disputes and issue refunds. |

Using these features will help you stay safe. Always monitor your transactions and report any suspicious activity.

Reporting And Analytics

Reporting and analytics play a crucial role in managing business finances. PayPal invoicing offers powerful tools that help users track and analyze their billing data. These tools provide insights to improve efficiency and make informed decisions.

Generating Reports

PayPal invoicing makes generating reports easy. With just a few clicks, users can create detailed reports. These reports show the status of invoices, payments received, and pending amounts. They help users understand their financial health at a glance.

Reports can be customized based on specific needs. Users can filter by date, client, or invoice status. This customization ensures that users get the information they need. The reports can also be exported to various formats like PDF or Excel.

Analyzing Billing Data

Analyzing billing data helps identify trends and patterns. PayPal invoicing provides tools to analyze this data easily. Users can track which clients pay on time and which ones do not. This information is vital for maintaining cash flow.

Users can also see which services or products generate the most revenue. This insight can guide business strategies. By understanding what works best, users can focus on profitable areas. Analyzing billing data helps in making data-driven decisions.

Credit: channelx.world

Tips For Effective Invoicing

Effective invoicing is crucial for maintaining cash flow in your business. Using Paypal Invoicing can streamline the process, ensuring you get paid faster. Here are some tips to help you create effective invoices that encourage timely payments.

Best Practices For Timely Payments

To ensure your invoices are paid on time, follow these best practices:

- Send invoices promptly: Don’t delay. Send invoices as soon as the work is completed.

- Be clear and detailed: Include all necessary details such as item descriptions, quantities, and prices.

- Set clear payment terms: Specify the due date and accepted payment methods.

- Follow up: Send reminders a few days before the due date.

- Offer multiple payment options: Make it easy for clients to pay by offering various methods.

Common Mistakes To Avoid

To avoid payment delays, steer clear of these common invoicing mistakes:

- Inaccurate details: Double-check all information before sending the invoice.

- Vague descriptions: Provide clear descriptions of the products or services provided.

- Complicated payment instructions: Keep payment instructions simple and straightforward.

- Not specifying due dates: Always include a specific payment due date.

- Ignoring follow-ups: Don’t hesitate to send reminders if payments are overdue.

By following these tips and avoiding common pitfalls, you can make your Paypal Invoicing more effective and ensure a smoother payment process.

Frequently Asked Questions

What Is Paypal Invoicing?

PayPal invoicing is a service that allows businesses to send professional invoices to customers. It helps streamline payments.

How Do I Create A Paypal Invoice?

To create a PayPal invoice, log in to your PayPal account, navigate to the ‘Tools’ section, and select ‘Invoicing’.

Are Paypal Invoices Free?

Creating and sending PayPal invoices is free. However, PayPal charges a small fee when payments are received.

Can I Customize Paypal Invoices?

Yes, you can customize PayPal invoices. You can add your logo, business information, and specific item details.

Conclusion

Paypal Invoicing simplifies your billing process. It saves time and reduces errors. Small businesses benefit from its user-friendly interface. Payments are faster and more secure. Customize invoices to match your brand. Track payments easily and stay organized. Paypal Invoicing supports multiple currencies.

It enhances customer satisfaction with easy payment options. Explore Paypal Invoicing to streamline your business today.