Personal Capital is a popular financial tool. It helps users manage their money easily.

Are you curious about its performance in 2025? This blog will dive into the latest reviews of Personal Capital. We will explore its features, user experiences, and any new updates. Whether you’re a long-time user or considering it for the first time, our insights will help you decide if it’s right for you.

Personal Capital has been known for its powerful tools and user-friendly interface. Let’s see how it fares in 2025. Stay with us as we uncover everything you need to know.

Introduction To Personal Capital

Welcome to our comprehensive review of Personal Capital in 2025. In this section, we will introduce you to Personal Capital. This financial tool has become popular over the years. It helps users manage their finances with ease.

What Is Personal Capital?

Personal Capital is an online financial tool. It helps individuals manage their money. Users can track their spending, savings, and investments. The platform also offers financial advice. It aims to simplify financial planning for everyone.

History And Evolution

Personal Capital started in 2009. It was founded by Bill Harris. He wanted to make financial planning easier. Over the years, the platform has grown. It now serves millions of users worldwide. Personal Capital has added many features since its launch. These include budgeting tools and retirement planning.

In 2020, Empower Retirement acquired Personal Capital. This merger brought more resources. It helped improve the platform’s services. Today, Personal Capital is known for its user-friendly interface. It continues to help people achieve their financial goals.

Credit: accidentallyretired.com

New Features In 2025

The year 2025 brings exciting updates to Personal Capital. These new features aim to enhance user experience and security. Below, we explore the most notable changes in Personal Capital Reviews 2025.

Enhanced Security Measures

Personal Capital has introduced several new security measures to protect user data. These measures include:

- Two-Factor Authentication: This adds an extra layer of security when logging in.

- Biometric Authentication: Use of fingerprints and facial recognition for secure access.

- Encrypted Data Storage: All data stored is now encrypted, ensuring privacy.

These features aim to give users peace of mind. Your financial data is safe and secure.

Ai-driven Financial Advice

The introduction of AI-driven financial advice is a game-changer. Personal Capital now uses artificial intelligence to offer personalized advice. Here are some benefits:

- Personalized Investment Recommendations: AI analyzes your financial situation and suggests tailored investments.

- Real-time Analysis: Get instant feedback and advice based on current market trends.

- Goal Tracking: AI helps you set and track financial goals effectively.

This feature makes financial planning easier and more accurate. It provides insights that were previously hard to obtain.

User Experience

The user experience with Personal Capital in 2025 has been a focal point for many. From the moment you log in, the experience is designed to be seamless. Let’s dive into the details.

Interface And Design

Personal Capital’s interface is clean and modern. The dashboard is easy to navigate. The color scheme is pleasing to the eye and helps reduce strain. Users can access various tools without confusion. Key features are prominently displayed.

The layout is intuitive. Menus are logically organized. This makes finding information quick and easy. Icons and buttons are clearly labeled. This enhances usability for everyone. The mobile app mirrors the web version, ensuring a consistent experience across devices.

Customer Support

Customer support is a crucial part of the user experience. Personal Capital offers multiple support channels. Users can reach out via phone, email, or live chat. The support team is responsive and knowledgeable.

There is also a comprehensive FAQ section on the website. This self-help resource covers a wide range of topics. Users can find answers to common questions easily. For more complex issues, the support team is available.

Support is available 24/7. This ensures users get help whenever they need it. The team is trained to handle various inquiries. This includes technical issues and financial advice.

| Support Channel | Availability | Response Time |

|---|---|---|

| Phone | 24/7 | Instant |

| 24/7 | Within 24 hours | |

| Live Chat | 24/7 | Instant |

In summary, the user experience with Personal Capital in 2025 is positive. The interface is user-friendly, and the customer support is robust. These elements contribute to an overall satisfying experience.

Credit: www.financialsamurai.com

Investment Tools

Investing can be challenging without the right tools. Personal Capital offers a suite of investment tools designed to simplify the process. These tools help users manage portfolios, plan for retirement, and achieve financial goals. Let’s dive deeper into the main features.

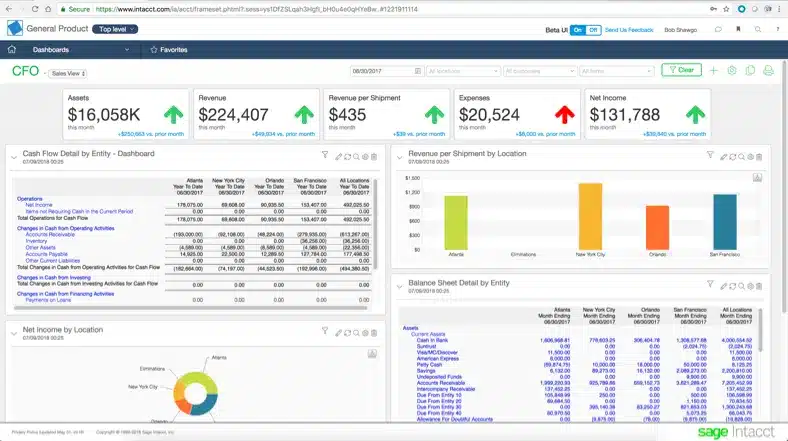

Portfolio Management

Personal Capital provides a robust portfolio management tool. This tool allows users to track all their investments in one place. It offers insights into asset allocation, investment performance, and risk management. Users can see how their portfolio compares to market benchmarks. This helps make informed decisions. The tool also suggests ways to diversify investments. This can help reduce risk and improve returns.

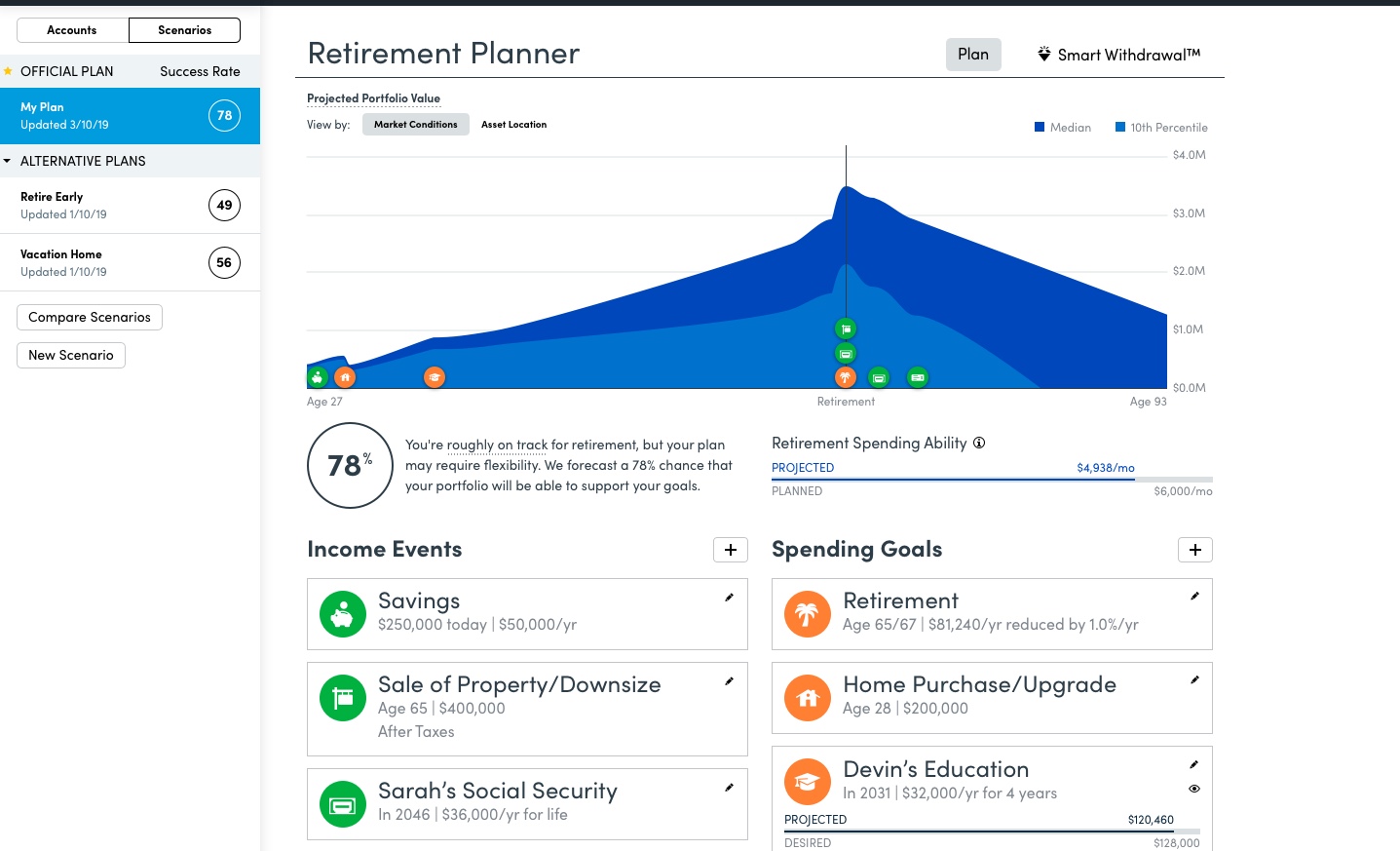

Retirement Planning

The retirement planning tool is another standout feature. It helps users plan for a secure retirement. Users can enter their financial details and retirement goals. The tool then creates a personalized retirement plan. It shows how much to save and where to invest. The tool also adjusts for inflation and market changes. This helps users stay on track for their retirement goals. The retirement planner is easy to use and very effective.

Budgeting And Saving

Personal Capital Reviews 2025 provide insights into how this financial tool can help with budgeting and saving. Understanding how to manage money effectively is crucial. Personal Capital offers tools to track expenses, set savings goals, and maintain financial health.

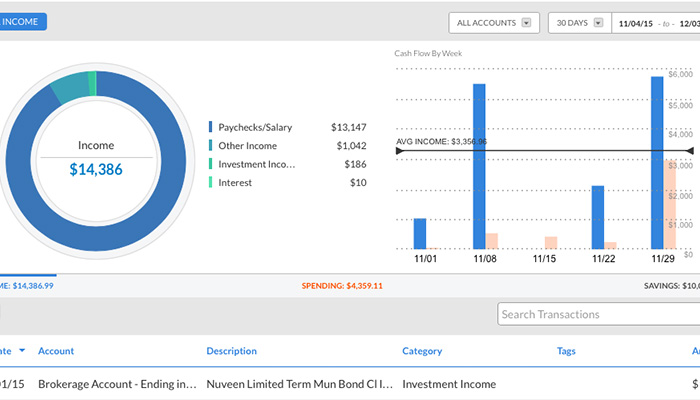

Expense Tracking

Personal Capital’s expense tracking feature helps users monitor their spending habits. It categorizes expenses, allowing users to see where their money goes. This helps identify unnecessary spending and areas to cut back. By viewing spending patterns, users can make informed decisions.

| Category | Amount Spent |

|---|---|

| Groceries | $500 |

| Utilities | $150 |

| Entertainment | $200 |

Users can set alerts for budget limits. This helps avoid overspending. Regular updates ensure users stay on top of their finances. Expense tracking is essential for maintaining a balanced budget.

Savings Goals

Setting savings goals is easy with Personal Capital. Users can define specific targets, such as a vacation or emergency fund. The tool tracks progress and provides reminders. This keeps users motivated and focused.

- Define target amount

- Set a timeline

- Track progress

Visual aids, like graphs, show how close users are to their goals. This visual representation can be a powerful motivator. Personal Capital’s savings goals feature ensures users stay on track.

Overall, Personal Capital Reviews 2025 highlight the importance of budgeting and saving. With efficient tools for expense tracking and setting savings goals, users can achieve financial stability.

Comparing Competitors

Personal Capital Reviews 2025 provide insights into financial management tools. Discover how it compares with other platforms. Learn about its features, benefits, and user experiences.

In 2025, choosing the right financial app can be tough. Many options exist, each with unique features. Comparing competitors helps you find the best fit.Other Financial Apps

Several financial apps compete with Personal Capital. Mint offers budget tracking and bill reminders. YNAB (You Need A Budget) focuses on budgeting to control spending. Robinhood provides easy access to stock trading. Each app has a distinct feature set aimed at specific needs.Advantages Of Personal Capital

Personal Capital offers a comprehensive financial overview. It combines budgeting, investment tracking, and retirement planning. Users appreciate its detailed insights into their finances. The app’s user-friendly interface makes it easy to navigate. Personal Capital also provides robust security features, ensuring data safety. “`User Testimonials

Personal Capital Reviews 2025 reveals a wealth of user experiences. Hearing from real users can help others decide. Below are some of the user testimonials.

Success Stories

Many users share their success with Personal Capital. Here are a few:

- John D.: “I managed to save 20% more this year. Personal Capital made budgeting easier.”

- Maria S.: “The retirement planner tool is a lifesaver. I now feel secure about my future.”

- Liam T.: “Their investment advice helped me diversify. I see better returns now.”

These stories highlight the platform’s value. Users appreciate its budgeting tools and investment advice.

Areas For Improvement

While many users are happy, some see room for improvement:

- Emily R.: “The mobile app can be slow. It needs optimization.”

- Kevin B.: “More educational resources would be helpful for beginners.”

- Sophia L.: “Customer support response time can be better.”

These points suggest focus areas for Personal Capital. Enhancing the mobile app and customer support could improve user satisfaction.

| User | Feedback | Suggested Improvement |

|---|---|---|

| Emily R. | App is slow | Optimize the mobile app |

| Kevin B. | Needs more educational resources | Add beginner resources |

| Sophia L. | Slow customer support | Improve support response time |

Future Trends In Finance

The financial landscape is always changing. New technologies, regulations, and trends shape how we manage money. By 2025, many exciting developments will influence personal finance. Let’s explore some key future trends in finance.

Technology Integration

Technology is transforming finance. Expect even more integration by 2025. Artificial Intelligence (AI) and Machine Learning (ML) will play bigger roles. They will help in predictive analytics and automated financial planning. Imagine getting real-time advice tailored to your spending habits.

Blockchain technology will also become common. It ensures secure and transparent transactions. This will reduce fraud and increase trust. Mobile Banking will continue to grow. More people will manage their finances on their phones.

Regulatory Changes

Regulations shape financial systems. By 2025, expect new rules to protect consumers. Governments will focus on cybersecurity and data privacy. This ensures your financial data is safe from breaches.

Cryptocurrency regulations will also evolve. Governments will create clear rules for digital currencies. This will make crypto investments safer and more mainstream. Environmental regulations will impact finance too. Companies will need to disclose their environmental impact. This will influence investment decisions.

Credit: thinksaveretire.com

Frequently Asked Questions

What Is Personal Capital?

Personal Capital is a financial service that helps you manage your money.

How Does Personal Capital Work?

Personal Capital tracks your income, expenses, and investments in one place.

Is Personal Capital Free To Use?

Yes, Personal Capital offers free tools for tracking your finances.

What Features Does Personal Capital Offer?

Personal Capital offers budgeting, investment tracking, and retirement planning tools.

Is Personal Capital Safe?

Yes, Personal Capital uses encryption and security measures to protect your data.

Can Personal Capital Help With Retirement Planning?

Yes, it offers tools to help you plan and track your retirement savings.

Does Personal Capital Have A Mobile App?

Yes, Personal Capital has a mobile app for iOS and Android devices.

How Does Personal Capital Make Money?

Personal Capital earns money through advisory fees for their wealth management services.

Conclusion

Personal Capital offers valuable tools for financial planning in 2025. The user-friendly interface helps manage personal finances easily. Budgeting features and investment insights stand out. With Personal Capital, you gain a clear view of your financial health. Many find it a helpful addition to their financial toolkit.

Try it and see how it fits your needs. Stay informed and make better financial decisions.