In today’s fast-paced business environment, managing finances efficiently is key to success. Whether you’re a small business owner, freelancer, or an accountant managing multiple clients, you need reliable accounting software to keep your financials in order. This is where QuickBooks Online shines.

But is it the right fit for your needs? If you’re searching for QuickBooks Online reviews in 2025, you’ve come to the right place. In this comprehensive guide, we’ll cover everything you need to know about QuickBooks Online, from its core features and pricing plans to user experiences, pros and cons, and FAQs. Let’s help you make an informed decision.

What is QuickBooks Online?

QuickBooks Online (QBO) is a cloud-based accounting software developed by Intuit, designed for small and medium-sized businesses. It provides users with powerful tools to track income and expenses, generate reports, manage payroll, and more — all from any device with internet access. Whether you’re a one-person operation or managing a team, QuickBooks Online can streamline your financial tasks, making it easier to stay on top of your business’s financial health

Why Are QuickBooks Online Reviews So Important?

Choosing the right accounting software is a crucial decision that can impact how efficiently you manage your business’s finances. Relying on QuickBooks Online reviews from other users can give you real-world insights into how the software performs.

Users often share experiences regarding the software’s ease of use, customer support, and overall effectiveness in meeting their business needs. Whether you’re considering switching to QuickBooks Online or just getting started with accounting software, reading reviews can save you time and money.

How To Use Accounting Software: A Beginner’s Guide

Key Features of QuickBooks Online

1. Cloud-Based Accessibility

One of the biggest advantages of QuickBooks Online is its cloud-based platform. You can access your account and manage your finances from anywhere, whether you’re at the office, on vacation, or at home.

2. Expense Tracking

Easily track income and expenses with features that allow you to categorize expenses, upload receipts, and connect your bank accounts for seamless reconciliation.

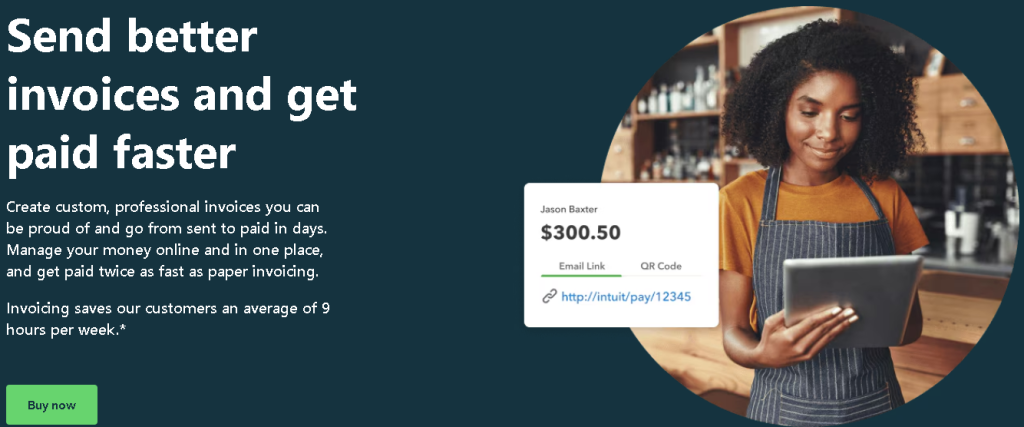

3. Invoicing

Create and send customized invoices directly from QuickBooks Online. You can also track the status of your invoices, send reminders for overdue payments, and automate recurring invoices.

4. Payroll Management

QuickBooks Online offers a comprehensive payroll solution, allowing you to manage employee pay, track work hours, and file taxes effortlessly.

5. Financial Reporting

Generate detailed financial reports, including profit and loss statements, balance sheets, and cash flow reports, to get a clear picture of your business’s financial performance.

6. Third-Party Integrations

QuickBooks Online integrates seamlessly with many other tools, such as PayPal, Square, Shopify, and more, making it easier to manage all aspects of your business from one place.

7. Tax Preparation

With built-in tax categories and reports, tax season becomes less of a headache. QuickBooks Online helps you track tax-deductible expenses and organize your financials for easier filing.

QuickBooks Online Pricing Plans: What Do Reviews Say?

1. Simple Start

This plan is designed for sole proprietors and small businesses with basic accounting needs. It includes basic expense tracking, invoicing, and reporting features.

- Price: $9/month

- Best for freelancers and very small businesses.

2. Essentials

The Essentials plan is ideal for businesses with more complex needs, offering multiple user access, time tracking, and bill management.

- Price: $14/month

- Best for small to medium-sized businesses needing extra features.

3. Plus

The Plus plan provides advanced features such as project tracking and inventory management, catering to growing businesses.

- Price: $20/month

- Best for medium-sized businesses that require more robust tools.

4. Advanced

The Advanced plan offers premium features like dedicated account support, deeper analytics, and customized workflows.

- Price: $38/month

- Best for larger businesses that need a fully customizable accounting solution.

QuickBooks Online Reviews: Pros and Cons

Pros

- Ease of Use: Many users praise QuickBooks Online for its intuitive interface and user-friendly navigation, making it suitable even for non-accountants.

- Cloud Accessibility: Being cloud-based means users can manage their finances from any location, which is a significant advantage for those who travel or work remotely.

- Customization: The ability to customize invoices and reports is another feature users appreciate. QuickBooks Online allows for flexible branding and data representation.

- Third-Party Integrations: Businesses benefit from seamless integrations with payment processors, eCommerce platforms, and other apps.

- Regular Updates: Intuit consistently updates QuickBooks Online with new features and improvements.

Cons

- Learning Curve for Advanced Features: Some users report that while the basic functions are easy to grasp, advanced features like reporting or payroll may take time to learn.

- Cost: Compared to other accounting software, QuickBooks Online can be expensive, particularly for businesses that require advanced functionality or additional users.

- Customer Support: Several QuickBooks Online reviews mention mixed experiences with customer support. While some users find it helpful, others feel response times could be improved.

How Does QuickBooks Online Compare to Competitors?

1. QuickBooks Online vs. Xero

Xero is another popular accounting software that competes directly with QuickBooks Online. While both are cloud-based and offer similar features, QuickBooks Online is often considered more user-friendly, especially for small business owners. However, Xero offers more affordable pricing for businesses with multiple users.

2. QuickBooks Online vs. FreshBooks

FreshBooks is tailored more toward freelancers and service-based businesses, while QuickBooks Online has broader functionality that supports product-based businesses and larger operations. FreshBooks offers simpler invoicing, while QuickBooks Online provides deeper reporting and inventory tracking.

3. QuickBooks Online vs. Wave

Wave is a free accounting software with basic functionality. While it’s a great option for small businesses or startups on a tight budget, it lacks the comprehensive features that QuickBooks Online offers, such as payroll and advanced reporting.

FAQs about QuickBooks Online

1. Is QuickBooks Online easy to use?

Yes, QuickBooks Online is known for its intuitive interface, which is designed to be user-friendly, even for individuals without an accounting background. However, some of its more advanced features may require a bit of time to master.

2. Can I access QuickBooks Online from my mobile device?

Yes, QuickBooks Online is cloud-based, meaning you can access it from any device with internet access, including smartphones and tablets. Intuit also offers a mobile app for added convenience.

3. Does QuickBooks Online offer a free trial?

Yes, QuickBooks Online offers a 30-day free trial, allowing you to explore its features before committing to a paid subscription.

4. Is QuickBooks Online secure?

QuickBooks Online uses industry-standard encryption and security measures to protect your data. Intuit regularly updates its platform to ensure the highest levels of security.

5. Can QuickBooks Online handle payroll?

Yes, QuickBooks Online has integrated payroll functionality. You can manage employee pay, benefits, and taxes directly from the platform.

Conclusion

After diving deep into QuickBooks Online reviews, it’s clear that this accounting software is a powerful tool for small to medium-sized businesses. Its ease of use, cloud-based accessibility, and robust feature set make it a favorite among many business owners. However, like any tool, it has its pros and cons.

For those who need advanced reporting, multi-user access, and seamless integrations, QuickBooks Online is worth the investment. On the other hand, if you’re a freelancer or small business owner looking for a more budget-friendly option, you might want to consider alternatives like Xero or Wave.

At the end of the day, the best accounting software for your business depends on your unique needs. Hopefully, this guide and the reviews we’ve gathered will help you make the right choice. Ready to try it out? QuickBooks Online offers a free trial, so you can see for yourself if it’s the right fit for your business!